filmov

tv

AI Winners, Losers and Wannabes: Valuing AI's Boost to NVIDIA's Value!

Показать описание

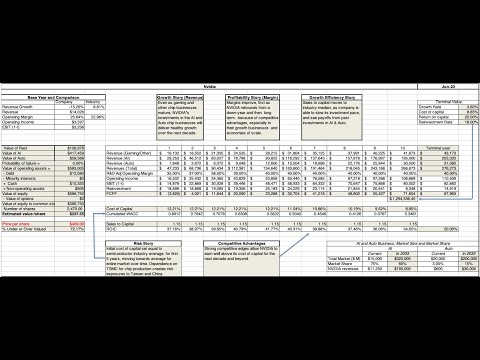

It is undeniable that AI has boosted stock prices across the board, and specifically so for companies that are core beneficiaries. I look at one of the perceived winners, NVIDIA, to estimate the AI effect on value, and whether the market price has overshot the mark. To set up the story and valuation of the company, I start by looking at both the semiconductor business over time and NVIDIA place in that business. NVIDIA has been able to post high growth in a maturing business by being in the right place at the right time - gaming, crypto and now AI, and my story/valuation of the company is built on the presumption that it will continue to be an opportunistic growth company, that deliver premium operating margins. Notwithstanding the optimistic tilt, I find the company over valued, though it is possible to map out pathways to get to a trillion dollar value.

'AI's Winners, Losers and Wannabes: Beyond Buzz Word'. Aswath Damodaran en Uruguay

AI Winners, Losers and Wannabes: Valuing AI's Boost to NVIDIA's Value!

AI’S WINNERS, LOSERS AND WANNABES: BEYOND BUZZ WORDS! Palestra com Aswath Damodaran

Who Will Be AI’s Winners And Losers | The Bottom Line

Nvidia valuation based on expectations that it can do no wrong, says NYU's Aswath Damodaran

BFDI Auditions With Genders

Investing in AI is tricky

Winners and losers of technology in 2023

NVIDIA’s Valuation and AI’s Negative Sum Game — with Aswath Damodaran | Prof G Markets

Professor Aswath Damodaran on AI, Valuation, Life, Teaching, NVIDIA, History, Books and more

Episode 274: The Pitfalls of Retirement Calculators and Being Unrealistically Conservative, AI M...

Nvidia Buy or Sell Part 2 | Professor Aswath Damodaran's View

AI Short video joks #viralvideo #shorts

Unlocking Success The Power of Responsibility and LongTerm Vision

Mohnish Pabrai on Mistakes, AI Euphoria, Nvidia, Microsoft

How to Value a Company: A Student's Valuation of Nvidia Corporation

largest startup acquisition marketplace

Do Not Sell Your Nvidia Shares! Here's Why

Should you be an Active or Passive Investor? By Professor Aswath Damodaran.

Top 6 AI Stocks for 2023 (Better than Nvidia & 1 AI Stock Under $100!)

NVIDIA: Horror-Prognose von der Value-Legende

Beat you Bot: Building your moat against AI!

Cisco Blowing a Bag for AI

'I'm Surprised The Market's Not Down More' | Aswath Damodaran

Комментарии

2:40:38

2:40:38

0:45:16

0:45:16

2:30:24

2:30:24

0:09:07

0:09:07

0:04:54

0:04:54

0:01:00

0:01:00

0:00:40

0:00:40

0:12:51

0:12:51

0:32:47

0:32:47

1:05:23

1:05:23

0:39:07

0:39:07

0:05:50

0:05:50

0:00:17

0:00:17

0:00:56

0:00:56

0:09:01

0:09:01

0:43:02

0:43:02

0:00:55

0:00:55

0:22:48

0:22:48

0:20:10

0:20:10

0:10:53

0:10:53

0:09:45

0:09:45

0:32:38

0:32:38

0:00:41

0:00:41

1:13:27

1:13:27