filmov

tv

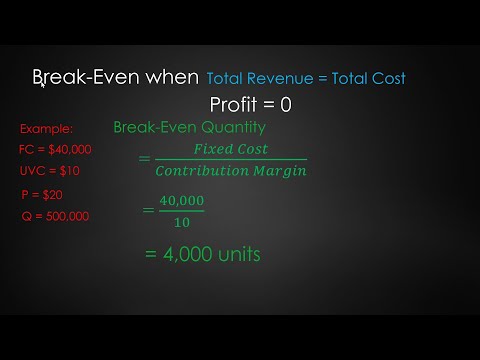

Simple Cost Volume Profit Problem

Показать описание

This video walks through a typical CVP problem, looking at the fixed costs and variable costs for a fictional barbershop.

Simple Cost Volume Profit Problem

Simple Cost Volume Profit Problem

MA22 - Breakeven Point and CVP Analysis - Explained

CVP Analysis Example- Cost Volume Profit analysis- Simple Example

CVP (BREAK EVEN) ANALYSIS (PART 1)

Cost Volume Profit (CVP) Analysis | Break-Even Analysis | Explained with Example

Cost Volume Profit (CVP) Analysis - Explained

Break-Even Analysis with Solved Problems

The Son of Finance of the Great Age Manhua Part 5 ManhuaRecap|manhwa|comic|AUDIOBOOK|LIGHT NOVEL

How to Calculate Break Even Points, Contribution Margin, and Target Quantity for a Specific Profit

Constructing a Break Even Chart

Cost volume profit analysis with multiple products

Cost Volume Profit analysis (Sensitivity analysis) - Example 9

Cost-Volume-Profit Relationships: Prob. B - PS

CVP (BREAK-EVEN) ANALYSIS (PART 2)

Cost Volume Profit Analysis – Breakeven - ACCA Performance Management (PM)

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner

Cost volume profit analysis (CVP Analysis)

CVP Analysis 2 | Problems and Solutions | Cost-Volume-Profit | Cost Control Techniques Unit 3

Break even analysis

Accounting for Management I CVP Analysis I Problems and Solutions I Part 1 I Hasham Ali Khan I

Cost-Volume-Profit

How To Analyze Cost Volume Profit Analysis | Managerial Accounting

CVP (BREAK-EVEN) ANALYSIS (PART 4)

Комментарии

0:06:37

0:06:37

0:06:37

0:06:37

0:11:00

0:11:00

0:03:15

0:03:15

0:24:22

0:24:22

0:15:20

0:15:20

0:01:22

0:01:22

0:07:01

0:07:01

9:05:46

9:05:46

0:10:19

0:10:19

0:01:54

0:01:54

0:06:02

0:06:02

0:13:45

0:13:45

0:19:42

0:19:42

0:18:46

0:18:46

0:27:46

0:27:46

0:48:22

0:48:22

0:06:09

0:06:09

0:24:59

0:24:59

0:03:35

0:03:35

0:25:02

0:25:02

0:05:50

0:05:50

0:06:58

0:06:58

0:24:17

0:24:17