filmov

tv

Break even analysis

Показать описание

How to calculate the break-even point for your business? This break-even analysis video explains the break-even point in words, in graphs, and in formulas, and encourages you to take various actions in your business to improve profitability.

A common definition of the break-even point is the sales volume where neither profit nor loss is made. An alternative way of saying the same thing: the break-even point is the sales volume where Contribution Margin $ equals Fixed Cost $.

Let’s look at the break-even point on a graph. On the horizontal axis the number of units sold, on the vertical axis the total dollars. Contribution Margin $ go up for every unit sold. Contribution Margin is revenue minus variable cost, what you sell the product for minus what it costs you to make an incremental unit. Fixed costs don’t vary with the number of units sold. Typical examples of fixed cost are rent, depreciation, and research and development expenditures. The break-even point is right here, where the two lines intersect. Let’s put some numbers to the example. If fixed costs are two hundred thousand dollars, and Contribution Margin is $4 per unit, then the business needs to sell fifty thousand units to break even.

If the business sells fewer than fifty thousand units (the red area), then Contribution Margin is lower than fixed costs, and the business is loss making. If the business sells more than fifty thousand units (the green area), then Contribution Margin is higher than fixed costs, and the business makes a profit.

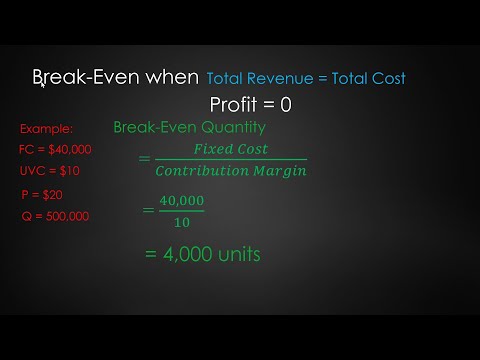

Let’s do the exact same break-even analysis, but in formulas. The break-even point is the sales volume where Contribution Margin $ equals Fixed Cost $. That’s the same as saying that the volume sold times the Contribution Margin per unit equals the Fixed Cost $. And that’s the same as saying that the volume sold to break-even is equal to the Fixed Cost $ divided by the Contribution Margin per unit. And that’s the same as saying that the volume sold to break-even is equal to the Fixed Cost $ divided by the selling price per unit minus the variable cost per unit.

Let’s fill in the numbers to illustrate. $200,000 of fixed costs. The business needs $200,000 in Contribution Margin to cover that $200,000 in fixed costs. At $4 Contribution Margin per unit ($10 selling price per unit minus $6 variable cost per unit), the volume sold needs to be 50,000 units.

That’s all very interesting, but what should a business owner do with this information? The first thing that comes to mind is to try to sell as many units as possible. Increase the volume sold. But that’s not the only choice the business owner has. He or she can also work on reducing the fixed costs, increasing the price per unit, or reducing the variable cost per unit. Work on all these variables at the same time, and the break-even point becomes dynamic instead of static!

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

A common definition of the break-even point is the sales volume where neither profit nor loss is made. An alternative way of saying the same thing: the break-even point is the sales volume where Contribution Margin $ equals Fixed Cost $.

Let’s look at the break-even point on a graph. On the horizontal axis the number of units sold, on the vertical axis the total dollars. Contribution Margin $ go up for every unit sold. Contribution Margin is revenue minus variable cost, what you sell the product for minus what it costs you to make an incremental unit. Fixed costs don’t vary with the number of units sold. Typical examples of fixed cost are rent, depreciation, and research and development expenditures. The break-even point is right here, where the two lines intersect. Let’s put some numbers to the example. If fixed costs are two hundred thousand dollars, and Contribution Margin is $4 per unit, then the business needs to sell fifty thousand units to break even.

If the business sells fewer than fifty thousand units (the red area), then Contribution Margin is lower than fixed costs, and the business is loss making. If the business sells more than fifty thousand units (the green area), then Contribution Margin is higher than fixed costs, and the business makes a profit.

Let’s do the exact same break-even analysis, but in formulas. The break-even point is the sales volume where Contribution Margin $ equals Fixed Cost $. That’s the same as saying that the volume sold times the Contribution Margin per unit equals the Fixed Cost $. And that’s the same as saying that the volume sold to break-even is equal to the Fixed Cost $ divided by the Contribution Margin per unit. And that’s the same as saying that the volume sold to break-even is equal to the Fixed Cost $ divided by the selling price per unit minus the variable cost per unit.

Let’s fill in the numbers to illustrate. $200,000 of fixed costs. The business needs $200,000 in Contribution Margin to cover that $200,000 in fixed costs. At $4 Contribution Margin per unit ($10 selling price per unit minus $6 variable cost per unit), the volume sold needs to be 50,000 units.

That’s all very interesting, but what should a business owner do with this information? The first thing that comes to mind is to try to sell as many units as possible. Increase the volume sold. But that’s not the only choice the business owner has. He or she can also work on reducing the fixed costs, increasing the price per unit, or reducing the variable cost per unit. Work on all these variables at the same time, and the break-even point becomes dynamic instead of static!

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:03:35

0:03:35

0:04:07

0:04:07

0:07:24

0:07:24

0:09:01

0:09:01

0:01:54

0:01:54

0:24:22

0:24:22

0:10:21

0:10:21

0:02:12

0:02:12

0:52:31

0:52:31

0:02:49

0:02:49

0:02:52

0:02:52

0:12:42

0:12:42

0:12:53

0:12:53

0:07:32

0:07:32

0:11:00

0:11:00

0:10:19

0:10:19

0:09:35

0:09:35

0:15:20

0:15:20

0:14:46

0:14:46

0:08:01

0:08:01

0:09:27

0:09:27

0:43:58

0:43:58

0:14:27

0:14:27

0:05:35

0:05:35