filmov

tv

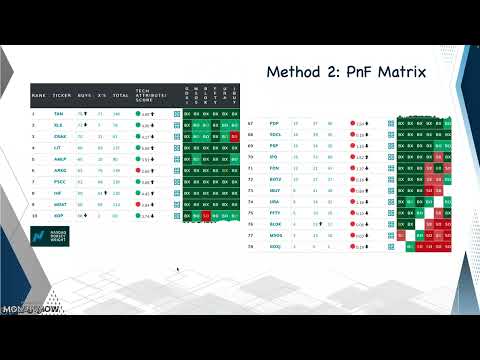

Using Relative Strength and Technical Analysis to Build Strong Portfolio Models with Downside Risk

Показать описание

In this content-rich, yet concise presentation, Adam Koos will share how he’s built technical analysis-based model portfolios to not only keep your money invested in what he calls “the playoff teams,” but also, how to play defense, using his trademarked Defense First™ risk management strategies.

Whether you’re an investor or trader, several groundbreaking live presentations. Check them out here!

Social Links:

About MoneyShow

Founded in 1981, MoneyShow is a privately held financial media company headquartered in Sarasota, Florida. As a global network of investing and trading education, MoneyShow presents an extensive agenda of live and online events that attract over 75,000 investors, traders, and financial advisors around the world. We are proud to bring together individuals, top market experts, analysts, and media in dynamic, face-to-face, and online learning forums that include highly acclaimed investment shows, conferences, and cruises.

For more than three decades, we've been empowering individuals with a passion for investing and trading. We arm individual investors and traders with state-of-the-art tools, a powerful skill set, and a clear understanding of the markets so they can pave their own path to profitability.

Whether you’re an investor or trader, several groundbreaking live presentations. Check them out here!

Social Links:

About MoneyShow

Founded in 1981, MoneyShow is a privately held financial media company headquartered in Sarasota, Florida. As a global network of investing and trading education, MoneyShow presents an extensive agenda of live and online events that attract over 75,000 investors, traders, and financial advisors around the world. We are proud to bring together individuals, top market experts, analysts, and media in dynamic, face-to-face, and online learning forums that include highly acclaimed investment shows, conferences, and cruises.

For more than three decades, we've been empowering individuals with a passion for investing and trading. We arm individual investors and traders with state-of-the-art tools, a powerful skill set, and a clear understanding of the markets so they can pave their own path to profitability.

Комментарии

0:04:22

0:04:22

0:02:48

0:02:48

0:00:56

0:00:56

0:00:53

0:00:53

0:45:13

0:45:13

0:33:25

0:33:25

0:03:24

0:03:24

0:16:51

0:16:51

0:12:22

0:12:22

0:09:06

0:09:06

0:06:21

0:06:21

0:06:41

0:06:41

0:27:45

0:27:45

0:46:15

0:46:15

0:00:27

0:00:27

0:00:25

0:00:25

0:06:36

0:06:36

0:10:10

0:10:10

0:02:30

0:02:30

0:00:45

0:00:45

0:11:20

0:11:20

0:05:14

0:05:14

0:09:06

0:09:06

0:01:52

0:01:52