filmov

tv

Becoming Your Own Banker: Part 26 - Top 7 Money Myths, Lies That Are Costing You Money

Показать описание

Becoming Your Own Banker: Part 26 - Top 7 Money Myths, Lies That Are Costing You Money

0:02:33 - Importance of Correct Thinking About Money

0:05:47 - Rethinking Household Income and Expenses

0:17:53 - Cash Flow and Financial Independence

0:23:25 - Passive Income and Asset-Based Thinking

0:26:28 - Retirement Income and Tax Deferral

0:30:47 - Analyzing the Impact of Tax Brackets

0:36:38 - Discussion on Future of Interest Rates

0:41:22 - Experts' Incorrect Recession Predictions

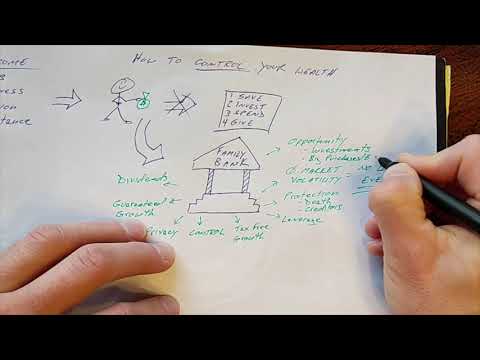

0:45:08 - The Myth of Using Banks

0:56:42 - Money Myths and Using Insurance Policies

What if what you think about money turned out not to be true? Even worse, what if you're believing lies that are costing you money?

Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns, our discussion breaks down seven misconceptions that have snaked their way into your financial beliefs. From the debated need for dual incomes to the complex dance around tax deferral, we're here to challenge the status quo and guide your finances out of the fog and into the clear.

We tackle the unsung heroism of stay-at-home parents, celebrating their economic significance and urging a pivot from the grind of labor-for-income to the wisdom of asset accumulation. This episode is laced with the principles of "Rich Dad Poor Dad" by Robert Kiyosaki, emphasizing the legacy of passive income over relentless hustle. Plus, we go beyond government-endorsed savings plans into a realm where your money doesn't just grow—it flourishes.

Wrapping up our financial saga, we scrutinize how interest rates echo through the economy and dissect the innovative concept of "becoming your own banker." Imagine controlling your capital flows, reaping the benefits of self-banking through insurance contracts, and even considering the burgeoning world of blockchain and cryptocurrencies. Our conversation is an open invitation: reevaluate your financial playbook, embrace a new narrative, and start constructing the life and business of your dreams.

Tune in as we continue our series through Nelson Nash's book, Becoming Your Own Banker, where we discuss increasing income, future taxes, banking, retirement plans, the stock market, paying cash, and life insurance needs analysis. And this is one place that the final points to consider might just be the most important part of the book.

If you want to keep more money, have more future income, and live with more peace of mind along the way, join us to for down-to-earth real talk about money that you'll wish you already knew.

#moneymyths

0:02:33 - Importance of Correct Thinking About Money

0:05:47 - Rethinking Household Income and Expenses

0:17:53 - Cash Flow and Financial Independence

0:23:25 - Passive Income and Asset-Based Thinking

0:26:28 - Retirement Income and Tax Deferral

0:30:47 - Analyzing the Impact of Tax Brackets

0:36:38 - Discussion on Future of Interest Rates

0:41:22 - Experts' Incorrect Recession Predictions

0:45:08 - The Myth of Using Banks

0:56:42 - Money Myths and Using Insurance Policies

What if what you think about money turned out not to be true? Even worse, what if you're believing lies that are costing you money?

Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns, our discussion breaks down seven misconceptions that have snaked their way into your financial beliefs. From the debated need for dual incomes to the complex dance around tax deferral, we're here to challenge the status quo and guide your finances out of the fog and into the clear.

We tackle the unsung heroism of stay-at-home parents, celebrating their economic significance and urging a pivot from the grind of labor-for-income to the wisdom of asset accumulation. This episode is laced with the principles of "Rich Dad Poor Dad" by Robert Kiyosaki, emphasizing the legacy of passive income over relentless hustle. Plus, we go beyond government-endorsed savings plans into a realm where your money doesn't just grow—it flourishes.

Wrapping up our financial saga, we scrutinize how interest rates echo through the economy and dissect the innovative concept of "becoming your own banker." Imagine controlling your capital flows, reaping the benefits of self-banking through insurance contracts, and even considering the burgeoning world of blockchain and cryptocurrencies. Our conversation is an open invitation: reevaluate your financial playbook, embrace a new narrative, and start constructing the life and business of your dreams.

Tune in as we continue our series through Nelson Nash's book, Becoming Your Own Banker, where we discuss increasing income, future taxes, banking, retirement plans, the stock market, paying cash, and life insurance needs analysis. And this is one place that the final points to consider might just be the most important part of the book.

If you want to keep more money, have more future income, and live with more peace of mind along the way, join us to for down-to-earth real talk about money that you'll wish you already knew.

#moneymyths

Комментарии

0:49:50

0:49:50

0:16:43

0:16:43

0:04:27

0:04:27

0:38:56

0:38:56

0:34:07

0:34:07

0:21:36

0:21:36

1:03:06

1:03:06

0:13:17

0:13:17

0:06:19

0:06:19

1:04:23

1:04:23

0:03:02

0:03:02

0:55:06

0:55:06

1:01:35

1:01:35

0:27:40

0:27:40

0:51:51

0:51:51

1:10:29

1:10:29

0:06:05

0:06:05

0:10:54

0:10:54

0:55:01

0:55:01

0:03:27

0:03:27

1:03:12

1:03:12

0:14:36

0:14:36

1:02:06

1:02:06

0:06:08

0:06:08