filmov

tv

Becoming Your Own Banker: Part 13 - Overfunding Life Insurance

Показать описание

Becoming Your Own Banker: Part 13 - Overfunding Life Insurance

0:03:00 - Overfunding Life Insurance Policies

0:07:45 - Maximizing Death Benefit With Life Insurance

0:18:37 - Time Window for Life Insurance

0:23:25 - Contract Design

0:32:20 - Maximizing Policy Value With Banking Component

0:37:10 - Design's Importance in Infinite Banking

0:41:50 - Deferred Compensation and Tax Implications

0:52:32 - Using Life Insurance for Cash Flow

1:00:00 - The Pitfalls of Universal Life Insurance

1:03:05 - Borrowing Against Risky Life Insurance Policies

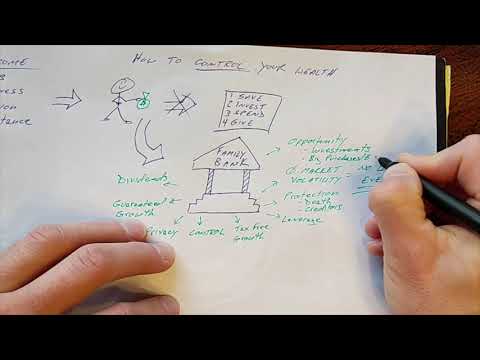

Prepare to unravel the mystique behind whole life insurance and the empowering concept of becoming your own banker. This episode holds the key to understanding how to fund a life insurance policy, maximize its cash value and reap the benefits. Our human-centric approach puts you, the listener, at the forefront as we examine how to expand your contract and build additional ones to create your own holistic financial system.

We dive right into the heart of constructing a life insurance contract that prioritizes both cash value and death benefit maximization. Intricacies of balancing ordinary life, term, and single premium by contract components are laid bare, aiming to achieve the optimal cash value to death benefit ratio. We also confront the challenges of adding a single premium paid-up addition to a contract and the complications that arise when human life value is exceeded – all in the pursuit of financial freedom and security.

Lastly, we venture into the evolution of universal life insurance over the past quarter-century, with special focus on its transformation following the 2001 stock market crash. The allure of universal life, index universal life, and variable universal life is scrutinized, revealing their potential pitfalls and unpredictability. Before we sign off, we arm you with a list of recommended readings to further your understanding. Included is Nelson Nash's enlightening book, Becoming Your Own Banker, as we champion the importance of financial literacy and independence. Tune in and embark on this enlightening financial journey with us.

For additional reading, check out these books recommended by Nelson Nash: The Truth About Mutual Funds, The Battle for the Soul of Capitalism, and Pirates of Manhattan.

Join us for this insightful look at life insurance, infinite banking, and gaining financial control!

0:03:00 - Overfunding Life Insurance Policies

0:07:45 - Maximizing Death Benefit With Life Insurance

0:18:37 - Time Window for Life Insurance

0:23:25 - Contract Design

0:32:20 - Maximizing Policy Value With Banking Component

0:37:10 - Design's Importance in Infinite Banking

0:41:50 - Deferred Compensation and Tax Implications

0:52:32 - Using Life Insurance for Cash Flow

1:00:00 - The Pitfalls of Universal Life Insurance

1:03:05 - Borrowing Against Risky Life Insurance Policies

Prepare to unravel the mystique behind whole life insurance and the empowering concept of becoming your own banker. This episode holds the key to understanding how to fund a life insurance policy, maximize its cash value and reap the benefits. Our human-centric approach puts you, the listener, at the forefront as we examine how to expand your contract and build additional ones to create your own holistic financial system.

We dive right into the heart of constructing a life insurance contract that prioritizes both cash value and death benefit maximization. Intricacies of balancing ordinary life, term, and single premium by contract components are laid bare, aiming to achieve the optimal cash value to death benefit ratio. We also confront the challenges of adding a single premium paid-up addition to a contract and the complications that arise when human life value is exceeded – all in the pursuit of financial freedom and security.

Lastly, we venture into the evolution of universal life insurance over the past quarter-century, with special focus on its transformation following the 2001 stock market crash. The allure of universal life, index universal life, and variable universal life is scrutinized, revealing their potential pitfalls and unpredictability. Before we sign off, we arm you with a list of recommended readings to further your understanding. Included is Nelson Nash's enlightening book, Becoming Your Own Banker, as we champion the importance of financial literacy and independence. Tune in and embark on this enlightening financial journey with us.

For additional reading, check out these books recommended by Nelson Nash: The Truth About Mutual Funds, The Battle for the Soul of Capitalism, and Pirates of Manhattan.

Join us for this insightful look at life insurance, infinite banking, and gaining financial control!

Комментарии

0:49:50

0:49:50

0:04:27

0:04:27

0:38:56

0:38:56

0:16:43

0:16:43

0:27:40

0:27:40

1:03:06

1:03:06

0:55:01

0:55:01

0:34:07

0:34:07

0:58:12

0:58:12

0:21:36

0:21:36

0:25:16

0:25:16

0:13:17

0:13:17

0:55:06

0:55:06

0:09:39

0:09:39

0:22:16

0:22:16

0:55:10

0:55:10

0:07:23

0:07:23

0:03:02

0:03:02

0:58:20

0:58:20

1:01:35

1:01:35

1:03:11

1:03:11

0:36:37

0:36:37

0:43:21

0:43:21

0:44:18

0:44:18