filmov

tv

Becoming Your Own Banker: Part 18 - 3 Things You Need to Really Get Started with Infinite Banking

Показать описание

Becoming Your Own Banker: Part 18 - The 3 Things You Need to Really Get Started with Infinite Banking

0:01:45 - Key Ingredients for Change

0:07:37 - Embrace Discomfort for Positive Change

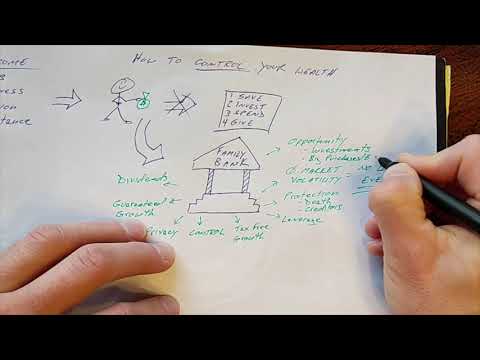

0:15:00 - Control Your Financial World

0:19:09 - Felt Needs and Controlling Banking

0:31:30 - Actions and Choices Impact Health

0:37:00 - Surrounding Yourself With Like-Minded People

0:40:38 - Escape the Rat Race Game

0:46:25 - The Value of Investing in Quality

Change isn't easy. It's almost always more comfortable to stay the same than it is to do something new.

What if the secret to financial freedom was already within your grasp, waiting for you to seize it? That's exactly what this episode of our podcast is about: the Infinite Banking concept and the important role that desire and mindset play in it. We'll guide you on the journey to being your own banker, starting with battling negative thoughts and stepping into a positive mindset. We also share nuggets of wisdom from Nelson Nash on the importance of capitalizing on your system and the critical need to understand Infinite Banking fully.

Have you ever felt a desire to change your financial state but didn't know where to start? We discuss how being uncomfortable with your current finances can actually act as a catalyst for change. We shed light on the power of Infinite Banking as a positive force in your financial life and how it can help you avoid falling for false promises of quick fixes. We also explore "felt needs" and controlling banking, pointing out how a lack of financial control can lead to higher interest payments and even insufficient retirement income.

In the spirit of shared knowledge and collective growth, we delve into the concept of wealth clubs and the importance of financial literacy. We highlight the need to avoid the 'arrival syndrome' often seen in social media groups and emphasize the importance of engaging in a discovery process. We also draw upon Robert Kiyosaki's Cash Flow game to illustrate the concept of financial control. Finally, we discuss the value of investing in quality and the cost of inaction, encouraging listeners to take action now in order to transform their financial strategy.

0:01:45 - Key Ingredients for Change

0:07:37 - Embrace Discomfort for Positive Change

0:15:00 - Control Your Financial World

0:19:09 - Felt Needs and Controlling Banking

0:31:30 - Actions and Choices Impact Health

0:37:00 - Surrounding Yourself With Like-Minded People

0:40:38 - Escape the Rat Race Game

0:46:25 - The Value of Investing in Quality

Change isn't easy. It's almost always more comfortable to stay the same than it is to do something new.

What if the secret to financial freedom was already within your grasp, waiting for you to seize it? That's exactly what this episode of our podcast is about: the Infinite Banking concept and the important role that desire and mindset play in it. We'll guide you on the journey to being your own banker, starting with battling negative thoughts and stepping into a positive mindset. We also share nuggets of wisdom from Nelson Nash on the importance of capitalizing on your system and the critical need to understand Infinite Banking fully.

Have you ever felt a desire to change your financial state but didn't know where to start? We discuss how being uncomfortable with your current finances can actually act as a catalyst for change. We shed light on the power of Infinite Banking as a positive force in your financial life and how it can help you avoid falling for false promises of quick fixes. We also explore "felt needs" and controlling banking, pointing out how a lack of financial control can lead to higher interest payments and even insufficient retirement income.

In the spirit of shared knowledge and collective growth, we delve into the concept of wealth clubs and the importance of financial literacy. We highlight the need to avoid the 'arrival syndrome' often seen in social media groups and emphasize the importance of engaging in a discovery process. We also draw upon Robert Kiyosaki's Cash Flow game to illustrate the concept of financial control. Finally, we discuss the value of investing in quality and the cost of inaction, encouraging listeners to take action now in order to transform their financial strategy.

Комментарии

0:04:27

0:04:27

0:10:24

0:10:24

0:49:50

0:49:50

0:16:43

0:16:43

0:03:20

0:03:20

0:21:36

0:21:36

0:55:01

0:55:01

0:04:34

0:04:34

0:24:06

0:24:06

0:46:15

0:46:15

0:10:29

0:10:29

0:58:20

0:58:20

0:00:59

0:00:59

0:03:27

0:03:27

0:04:40

0:04:40

0:58:52

0:58:52

0:00:12

0:00:12

0:29:41

0:29:41

0:28:42

0:28:42

0:14:36

0:14:36

0:44:18

0:44:18

0:47:58

0:47:58

0:21:37

0:21:37

0:27:40

0:27:40