filmov

tv

More book recommendations from Warren Buffett & Charlie Munger

Показать описание

Warren Buffett and Charlie Munger answer a question on Disney and recommend books at the 1996 Berkshire Hathaway annual meeting.

Book recommendations;

(The above are affiliate links.)

Book recommendations;

(The above are affiliate links.)

More book recommendations from Warren Buffett & Charlie Munger

Read 5 Books Recommended by Warren Buffett 📚

Warren Buffett: 5 Books That Made Me MILLIONS 📖📈#stocks

5 Best Books On Warren Buffett Investment strategy 📚

Books Recommended By Warren Buffett | Must Read Books | Investment Books

5 Books recommended by Warren Buffett 💰📚

Warren Buffett Recommends Best Investing Book For Beginners 2023

10 Investing Books Recommended By Warren Buffett

I brilliantly explains levels of wealth-Warren Buffet

TOP 10 Book Recommendations By WARREN BUFFETT & BILL GATES To Inspire You!

Another set of book recommendations from Warren Buffett & Charlie Munger

Warren Buffett: 11 Books That Made Me MILLIONS (Must READ)

Warren Buffett's Recommended Books for Investing

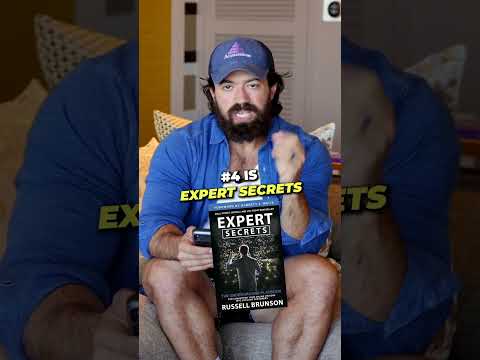

The BEST Book Recommendations To GET RICH

Warren Buffett on the investing book that changed his life: “The Intelligent Investor” by Ben Graham...

Books that Helped Iman Gadzhi Succeed

3 Books Recommended By BOB PROCTOR

The 4 Best Books About Money - Part 1 📚

Top 13 books every business owner should read

Why READING habits IS IMPORTANT 🔥bY Elon Musk #inspiration #viral

Warren Buffett Top10 BOOKS Recommendation Summary - {Must Read} - Investment Secrets

Warren Buffett The only Books you need to Read

Jack Edwards on Haruki Murakami's problematic portrayal of women #booktube #booklover #booktok

Warren Buffett Book Recommendations #Shorts

Комментарии

0:08:00

0:08:00

0:00:09

0:00:09

0:00:16

0:00:16

0:00:31

0:00:31

0:00:57

0:00:57

0:02:44

0:02:44

0:04:29

0:04:29

0:09:34

0:09:34

0:03:59

0:03:59

0:09:21

0:09:21

0:05:32

0:05:32

0:13:46

0:13:46

0:00:46

0:00:46

0:00:34

0:00:34

0:00:15

0:00:15

0:00:31

0:00:31

0:00:17

0:00:17

0:00:33

0:00:33

0:00:43

0:00:43

0:00:52

0:00:52

0:04:35

0:04:35

0:02:45

0:02:45

0:00:44

0:00:44

0:00:52

0:00:52