filmov

tv

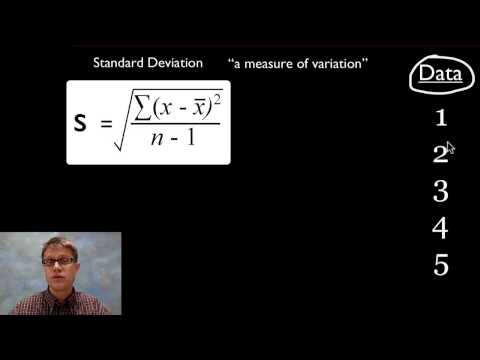

What is Standard Deviation?

Показать описание

Welcome to the Investors Trading Academy talking glossary of financial terms and events.

Our word of the day is “Standard Deviation”.

In finance, standard deviation is often used as a measure of the risk associated with price-fluctuations of a given asset or the risk of a portfolio of assets actively managed mutual funds, index mutual funds, or ETFs. Risk is an important factor in determining how to efficiently manage a portfolio of investments because it determines the variation in returns on the asset and/or portfolio and gives investors a mathematical basis for investment decisions -known as mean-variance optimization.

The fundamental concept of risk is that as it increases, the expected return on an investment should increase as well, an increase known as the risk premium. In other words, investors should expect a higher return on an investment when that investment carries a higher level of risk or uncertainty. When evaluating investments, investors should estimate both the expected return and the uncertainty of future returns. Standard deviation provides a quantified estimate of the uncertainty of future returns.

For example, let's assume an investor had to choose between two stocks. Stock A over the past 20 years had an average return of 10 percent, with a standard deviation of 20 percentage points and Stock B, over the same period, had average returns of 12 percent but a higher standard deviation of 30 pp.

On the basis of risk and return, an investor may decide that Stock A is the safer choice, because Stock B's additional two percentage points of return are not worth the additional 10 pp standard deviation.

By Barry Norman, Investors Trading Academy

Our word of the day is “Standard Deviation”.

In finance, standard deviation is often used as a measure of the risk associated with price-fluctuations of a given asset or the risk of a portfolio of assets actively managed mutual funds, index mutual funds, or ETFs. Risk is an important factor in determining how to efficiently manage a portfolio of investments because it determines the variation in returns on the asset and/or portfolio and gives investors a mathematical basis for investment decisions -known as mean-variance optimization.

The fundamental concept of risk is that as it increases, the expected return on an investment should increase as well, an increase known as the risk premium. In other words, investors should expect a higher return on an investment when that investment carries a higher level of risk or uncertainty. When evaluating investments, investors should estimate both the expected return and the uncertainty of future returns. Standard deviation provides a quantified estimate of the uncertainty of future returns.

For example, let's assume an investor had to choose between two stocks. Stock A over the past 20 years had an average return of 10 percent, with a standard deviation of 20 percentage points and Stock B, over the same period, had average returns of 12 percent but a higher standard deviation of 30 pp.

On the basis of risk and return, an investor may decide that Stock A is the safer choice, because Stock B's additional two percentage points of return are not worth the additional 10 pp standard deviation.

By Barry Norman, Investors Trading Academy

Комментарии

0:07:49

0:07:49

0:01:47

0:01:47

0:04:18

0:04:18

0:05:50

0:05:50

0:00:32

0:00:32

0:07:10

0:07:10

0:08:16

0:08:16

0:09:30

0:09:30

0:03:20

0:03:20

0:14:22

0:14:22

0:07:50

0:07:50

0:07:14

0:07:14

0:02:57

0:02:57

0:10:21

0:10:21

0:08:34

0:08:34

0:04:56

0:04:56

0:12:34

0:12:34

0:01:00

0:01:00

0:01:53

0:01:53

0:13:47

0:13:47

0:15:24

0:15:24

0:08:16

0:08:16

0:00:35

0:00:35

0:09:51

0:09:51