filmov

tv

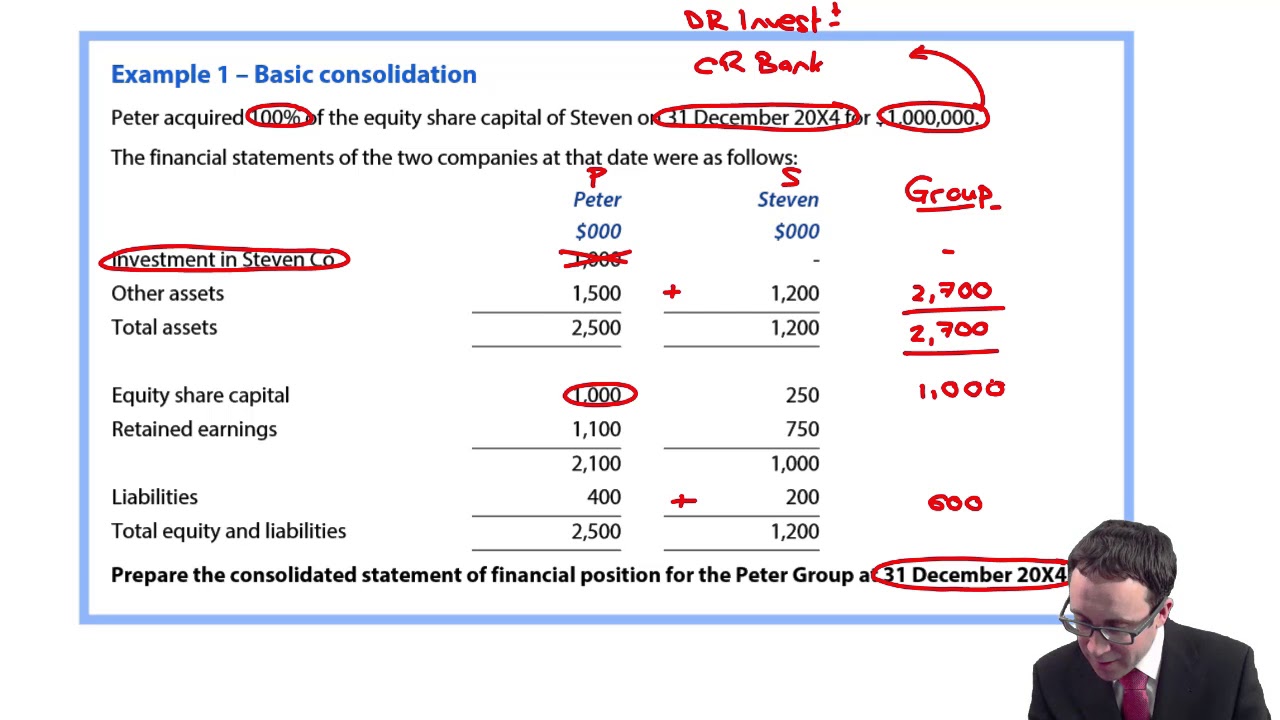

Group SFP - Basic consolidation (revision) - ACCA Financial Reporting (FR)

Показать описание

Group SFP - Basic consolidation (revision) - ACCA Financial Reporting (FR)

Free lectures for the ACCA Financial Reporting (FR) Exam

To benefit from this lecture, visit OpenTuition to download the notes used in the lecture and access all ACCA free resources.

Access to all Financial Reporting lectures, and Ask the ACCA Tutor Forums

Please go to opentuition to post questions to our ACCA Tutor, we do not provide support on youtube comments section.

Free lectures for the ACCA Financial Reporting (FR) Exam

To benefit from this lecture, visit OpenTuition to download the notes used in the lecture and access all ACCA free resources.

Access to all Financial Reporting lectures, and Ask the ACCA Tutor Forums

Please go to opentuition to post questions to our ACCA Tutor, we do not provide support on youtube comments section.

Group SFP - Basic consolidation (revision) - ACCA Financial Reporting (FR)

Group SFP - Example (Basic consolidation) - ACCA Financial Reporting (FR)

Group SPL - Basic consolidation - ACCA Financial Reporting (FR)

Basic group structures – Basic consolidation examples - ACCA SBR

Example: How To Consolidate

Group SFP - NCI - ACCA Financial Reporting (FR)

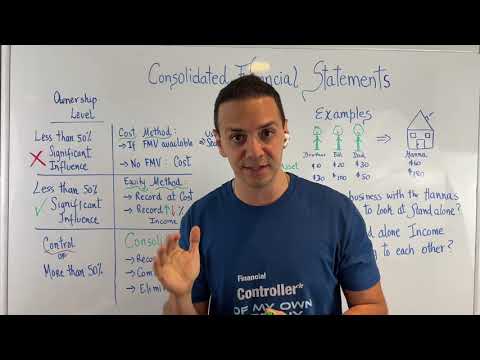

Consolidated Financial Statements | Group Accounts | Basic Consolidation Concepts | IFRS 10 | IFRS 3

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 1) - IFRS 10

Basic group structures - Basic consolidation example - ACCA (SBR) lectures

How (& When) To Consolidate Financial Statements

Financial Consolidations of FS - Practical Math Solutions | Group-SFP Basic Consolidation (Part-A)

Basic group structures – SFP workings and adjustments - ACCA SBR

Group SFP - Goodwill - ACCA Financial Reporting (FR)

Consolidated financial statements

Group Accounts The Consolidated Statement of Financial Position (1a) - ACCA (FA) lectures

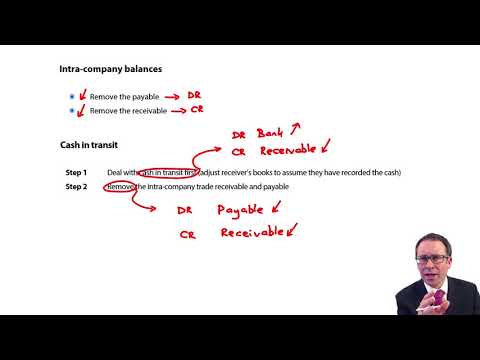

Group SFP - intra group and cash in transit - ACCA Financial Reporting (FR)

CIMA F1 Consolidated Statement of Profit or Loss - Basic Consolidation

Group SFP - FV adjustments - ACCA Financial Reporting (FR)

CIMA F1 Basic consolidation

Group SFP - Example (PUPs) - ACCA Financial Reporting (FR)

Group SFP - Unrealised profit and inventory in transit - ACCA Financial Reporting (FR)

Group SFP - NCA PUPs - ACCA Financial Reporting (FR)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (PART 5) - INTRA-GROUP ADJUSTMENTS

BASIC CONSOLIDATION

Комментарии

0:20:08

0:20:08

0:15:52

0:15:52

0:08:34

0:08:34

0:27:31

0:27:31

0:10:47

0:10:47

0:17:23

0:17:23

0:30:26

0:30:26

0:45:21

0:45:21

0:25:08

0:25:08

0:15:05

0:15:05

1:28:44

1:28:44

0:24:01

0:24:01

0:21:07

0:21:07

0:10:29

0:10:29

0:20:25

0:20:25

0:11:24

0:11:24

0:18:22

0:18:22

0:13:27

0:13:27

0:16:06

0:16:06

0:19:19

0:19:19

0:11:16

0:11:16

0:05:57

0:05:57

0:57:36

0:57:36

0:20:10

0:20:10