filmov

tv

How To Calculate Depreciation In Excel

Показать описание

*How To Calculate Depreciation In Excel*

Depreciation is the reduction in the value of a tangible asset over time due to wear and tear, aging, or obsolescence. It is an accounting method used to allocate the cost of a long-term asset over its useful life. The purpose of depreciation is to match the cost of an asset with the revenue it generates over its useful life. By allocating the cost of the asset over its useful life, depreciation helps to determine the accurate net income of a business. Without depreciation, the cost of the asset would be expensed in the year it was acquired, which would result in an artificially low net income in that year and an artificially high net income in future years.

To use the different depreciation methods in Excel, you can use the built-in depreciation functions. Here are the steps to use each method:

*Straight-line depreciation (SLN): *

SLN - Straight-line depreciation method is a commonly used method for calculating depreciation, which assumes that the asset depreciates evenly over its useful life. Under this method, the depreciation expense is calculated by dividing the cost of the asset by its useful life.

To do this calculation in excel, Type =SLN(cost, salvage, life) into a cell, and press enter.

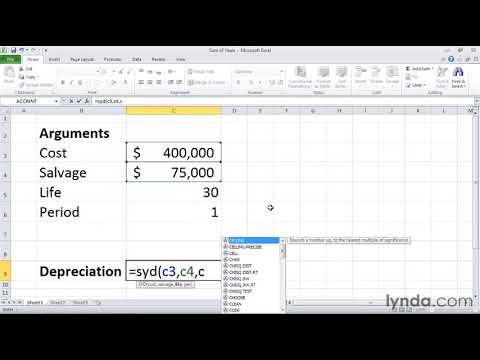

*Sum-of-year’s digits depreciation (SYD): *

SYD - Sum-of-year’s digits depreciation method is a depreciation method that accelerates the depreciation of an asset by using a fraction that decreases over time. Under this method, the depreciation expense for each year is determined by dividing the remaining useful life by the sum of the digits.

Type =SYD (cost, salvage, life, period) into a cell, and press enter

*Fixed declining balance depreciation (DB): *

DB - Fixed declining balance depreciation method is a depreciation method that applies a fixed percentage rate to the asset's book value each year. This method assumes that the asset depreciates more rapidly in its early years and gradually slows down over time.

Type "=DB(cost,salvage,life,period, [factor])" into a cell, and Press enter.

*Double declining balance depreciation (DDB): *

DDB - Double declining balance method is a more accelerated form of the declining balance method. Under this method, a fixed percentage rate (usually double the straight-line rate) is applied to the asset's book value each year until the depreciation expense reaches the salvage value.

Type =DDB(cost, salvage, life, period, [factor], [factor2]) into a cell and press enter.

*Variable declining balance depreciation (VDB): *

VDB - Variable declining balance method is a depreciation method that allows for a change in the depreciation rate in each year of an asset's useful life. This method is often used for assets that have different levels of productivity in different periods of their useful lives. The VDB method can also be used to calculate a partial year's depreciation expense when the asset is acquired or disposed of during the year.

Type "=VDB(cost,salvage,life,start_period,end_period,[factor],[no_switch])" into a cell.

Where "cost" is the original cost of the asset, "salvage" is the estimated salvage value of the asset at the end of its useful life, "life" is the number of years the asset will be used, "start_period" is the year for which you want to start calculating the depreciation expense, "end_period" is the year for which you want to stop calculating the depreciation expense, "[factor]" is an optional argument specifying the depreciation rate, and "[no_switch]" is an optional argument specifying whether to switch to straight-line depreciation when the depreciation expense is greater than the declining balance expense.

#Depreciation #SLN #SYD #DB #DDB #VDB

Thanks for watching.

----------------------------------------------------------------------------------------

Support the channel with as low as $5

----------------------------------------------------------------------------------------

Please subscribe to #excel10tutorial

Here goes the most recent video of the channel:

Playlists:

Social media:

Depreciation is the reduction in the value of a tangible asset over time due to wear and tear, aging, or obsolescence. It is an accounting method used to allocate the cost of a long-term asset over its useful life. The purpose of depreciation is to match the cost of an asset with the revenue it generates over its useful life. By allocating the cost of the asset over its useful life, depreciation helps to determine the accurate net income of a business. Without depreciation, the cost of the asset would be expensed in the year it was acquired, which would result in an artificially low net income in that year and an artificially high net income in future years.

To use the different depreciation methods in Excel, you can use the built-in depreciation functions. Here are the steps to use each method:

*Straight-line depreciation (SLN): *

SLN - Straight-line depreciation method is a commonly used method for calculating depreciation, which assumes that the asset depreciates evenly over its useful life. Under this method, the depreciation expense is calculated by dividing the cost of the asset by its useful life.

To do this calculation in excel, Type =SLN(cost, salvage, life) into a cell, and press enter.

*Sum-of-year’s digits depreciation (SYD): *

SYD - Sum-of-year’s digits depreciation method is a depreciation method that accelerates the depreciation of an asset by using a fraction that decreases over time. Under this method, the depreciation expense for each year is determined by dividing the remaining useful life by the sum of the digits.

Type =SYD (cost, salvage, life, period) into a cell, and press enter

*Fixed declining balance depreciation (DB): *

DB - Fixed declining balance depreciation method is a depreciation method that applies a fixed percentage rate to the asset's book value each year. This method assumes that the asset depreciates more rapidly in its early years and gradually slows down over time.

Type "=DB(cost,salvage,life,period, [factor])" into a cell, and Press enter.

*Double declining balance depreciation (DDB): *

DDB - Double declining balance method is a more accelerated form of the declining balance method. Under this method, a fixed percentage rate (usually double the straight-line rate) is applied to the asset's book value each year until the depreciation expense reaches the salvage value.

Type =DDB(cost, salvage, life, period, [factor], [factor2]) into a cell and press enter.

*Variable declining balance depreciation (VDB): *

VDB - Variable declining balance method is a depreciation method that allows for a change in the depreciation rate in each year of an asset's useful life. This method is often used for assets that have different levels of productivity in different periods of their useful lives. The VDB method can also be used to calculate a partial year's depreciation expense when the asset is acquired or disposed of during the year.

Type "=VDB(cost,salvage,life,start_period,end_period,[factor],[no_switch])" into a cell.

Where "cost" is the original cost of the asset, "salvage" is the estimated salvage value of the asset at the end of its useful life, "life" is the number of years the asset will be used, "start_period" is the year for which you want to start calculating the depreciation expense, "end_period" is the year for which you want to stop calculating the depreciation expense, "[factor]" is an optional argument specifying the depreciation rate, and "[no_switch]" is an optional argument specifying whether to switch to straight-line depreciation when the depreciation expense is greater than the declining balance expense.

#Depreciation #SLN #SYD #DB #DDB #VDB

Thanks for watching.

----------------------------------------------------------------------------------------

Support the channel with as low as $5

----------------------------------------------------------------------------------------

Please subscribe to #excel10tutorial

Here goes the most recent video of the channel:

Playlists:

Social media:

0:05:22

0:05:22

0:06:52

0:06:52

0:03:20

0:03:20

0:11:24

0:11:24

0:05:35

0:05:35

0:01:31

0:01:31

0:08:37

0:08:37

0:05:38

0:05:38

0:07:37

0:07:37

0:27:18

0:27:18

0:05:07

0:05:07

0:04:57

0:04:57

0:02:13

0:02:13

0:04:24

0:04:24

0:43:19

0:43:19

0:06:45

0:06:45

0:08:45

0:08:45

0:06:00

0:06:00

0:52:31

0:52:31

0:00:59

0:00:59

0:09:47

0:09:47

0:11:26

0:11:26

0:08:32

0:08:32

0:03:11

0:03:11