filmov

tv

Depreciation explained

Показать описание

What is depreciation? How to calculate depreciation? Depreciation, amortization and CapEx tutorial. Overview of depreciation accounting (concept and application), and related topics such as accumulated depreciation, book value, residual value, historical cost, fixed assets, amortization, useful life, capital expenditures (CapEx) and capitalization. Intended for students and business people at both entry and advanced levels.

⏱️TIMESTAMPS⏱️

0:00 Introduction

0:20 What is depreciation

1:22 Depreciation definition

2:50 Useful life of an asset

4:05 Accounting for depreciation

4:52 Depreciation journal entries

5:25 Historical cost of an asset

6:20 Straight-line depreciation vs other depreciation methods

7:26 Residual value of an asset

7:55 Depreciation vs amortization

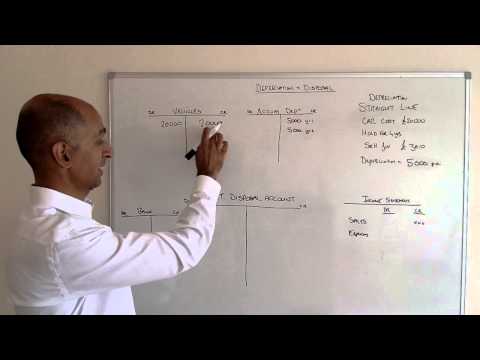

Depreciation is the accounting process of allocating the cost of tangible assets to current expense in a systematic and rational manner in those periods expected to benefit from the use of the asset.

That last part of the sentence “in those periods expected to benefit from the use of the asset” is called the matching principle: expenses should be recorded during the period in which they are incurred.

Depreciation is often referred to as a non-cash expense. The cash was spent when we bought the asset, depreciation allocates the value of the asset over the years in which we use it.

As you can see from the journal entries in the video, depreciation is not about putting money aside for buying a new asset once the current one is at the end of its lifetime. Depreciation takes the amount you spent to buy the asset, and allocates a proportionate amount to each of the periods of its useful life. Hopefully the company that we are looking at generates very profitable products or services with the building, machine and truck that they are using, and the cash generated with selling these products and services can be used in the future to buy replacements for the assets that are at the end of their lifetime.

What can you include in the value of the asset on the balance sheet when you buy it? This depends on the accounting rules that your company applies, which in turn depends on the country where you are located and whether you are accounting for tax or statutory purposes, or for reporting to the stock market. Generally, what you pay for the asset to the supplier, as well as transportation and installation cost can be capitalized. Capitalization means recording things as fixed assets on your balance sheet.

It’s important to have consistency of method in the way you depreciate assets. A company could change from linear depreciation of its trucks to a depreciation based on units of production (which in the case of trucks would be mileage), if that presents a more fair and accurate representation of the value of the assets. However, you can’t be flipping back and forth between methods randomly every year, as that would adversely impact the year-over-year comparisons, and it would not come across as very systematic and rational per our definition earlier on.

What is the difference between depreciation and amortization? The concept is the same, but depreciation and amortization are applied to different types of assets. You depreciate a tangible asset, and amortize an intangible asset. The threshold levels (minimum total spend) and capitalization criteria for intangible assets tend to be a lot more stringent than those for tangible assets.

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

0:00 Introduction

0:20 What is depreciation

1:22 Depreciation definition

2:50 Useful life of an asset

4:05 Accounting for depreciation

4:52 Depreciation journal entries

5:25 Historical cost of an asset

6:20 Straight-line depreciation vs other depreciation methods

7:26 Residual value of an asset

7:55 Depreciation vs amortization

Depreciation is the accounting process of allocating the cost of tangible assets to current expense in a systematic and rational manner in those periods expected to benefit from the use of the asset.

That last part of the sentence “in those periods expected to benefit from the use of the asset” is called the matching principle: expenses should be recorded during the period in which they are incurred.

Depreciation is often referred to as a non-cash expense. The cash was spent when we bought the asset, depreciation allocates the value of the asset over the years in which we use it.

As you can see from the journal entries in the video, depreciation is not about putting money aside for buying a new asset once the current one is at the end of its lifetime. Depreciation takes the amount you spent to buy the asset, and allocates a proportionate amount to each of the periods of its useful life. Hopefully the company that we are looking at generates very profitable products or services with the building, machine and truck that they are using, and the cash generated with selling these products and services can be used in the future to buy replacements for the assets that are at the end of their lifetime.

What can you include in the value of the asset on the balance sheet when you buy it? This depends on the accounting rules that your company applies, which in turn depends on the country where you are located and whether you are accounting for tax or statutory purposes, or for reporting to the stock market. Generally, what you pay for the asset to the supplier, as well as transportation and installation cost can be capitalized. Capitalization means recording things as fixed assets on your balance sheet.

It’s important to have consistency of method in the way you depreciate assets. A company could change from linear depreciation of its trucks to a depreciation based on units of production (which in the case of trucks would be mileage), if that presents a more fair and accurate representation of the value of the assets. However, you can’t be flipping back and forth between methods randomly every year, as that would adversely impact the year-over-year comparisons, and it would not come across as very systematic and rational per our definition earlier on.

What is the difference between depreciation and amortization? The concept is the same, but depreciation and amortization are applied to different types of assets. You depreciate a tangible asset, and amortize an intangible asset. The threshold levels (minimum total spend) and capitalization criteria for intangible assets tend to be a lot more stringent than those for tangible assets.

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:08:37

0:08:37

0:01:19

0:01:19

0:11:24

0:11:24

0:02:44

0:02:44

0:03:52

0:03:52

0:03:48

0:03:48

0:00:59

0:00:59

0:05:53

0:05:53

1:08:52

1:08:52

0:05:28

0:05:28

0:06:52

0:06:52

0:09:36

0:09:36

0:04:41

0:04:41

0:10:16

0:10:16

0:07:18

0:07:18

0:04:18

0:04:18

0:08:06

0:08:06

0:05:32

0:05:32

0:06:43

0:06:43

0:08:04

0:08:04

0:02:54

0:02:54

0:05:54

0:05:54

0:52:31

0:52:31

0:04:45

0:04:45