filmov

tv

5 Proven Ways to Achieve Financial Security

Показать описание

Offers from Today's Sponsors

Listen to more from Ramsey Network

Ramsey Solutions Privacy Policy:

Products:

'5 Proven Ways to Achieve Flow State and Unlock Peak Productivity. #mentalfocus #mentalenergy

5 Proven Ways to Build Muscle (5x Faster)

5 Proven Ways to Increase Testosterone

Pop Your Sacroiliac Joint Back In (5 Proven Methods)

5 Proven Ways to Gain Muscle FASTER (not for beginners)

5 Proven Ways To Fix Your Double Stroke (Drum Lesson)

5 Proven Ways to Get Better Gas Mileage in Your Car

5 Proven Ways To Start A Copywriting Career With No Portfolio (And No Experience)

Top 5 Best Uses Dates #viralfacts #viralshort #trendingshorts #gsfactbysalman

5 BEST Ways to Study Effectively | Scientifically Proven

5 PROVEN Ways To Get MORE Subscribers

Power Twister Biceps Workout | 5 Best Exercises‼️#biggerarms

5 BEST Ways to Overcome Laziness | Scientifically Proven

BEST MOVEMENT CLASSES FOR SEASON 5 RELOADED 👑🔥

5 Proven Ways to Make Money on Social Media (No Product Needed)

Best 5 Side Hustles To Make $550/day

5 BEST Ways to Make Yourself Study When You Have ZERO Motivation | Scientifically Proven

Top 5 Best Gaming Mice for Fortnite!

Best 5 Asanas For Calm Your Mind | Yoga Poses for Stress Relief and Anxiety | Shivangi Desai

5 BEST Ways to Wake Up at 4:00 AM Every Day | Scientifically Proven

Top 5 Best Ways to Earn Robux on Roblox in 2023! 🤑#roblox #shorts #viral

5 best clitoris stimulation techniques (most powerful) | Alexey Welsh

The 5 BEST Fruits In Blox Fruits

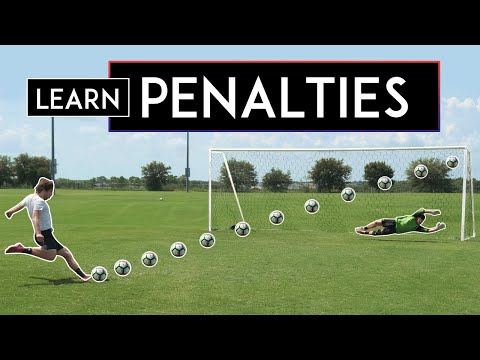

5 BEST WAYS to SCORE PENALTY KICKS

Комментарии

0:00:59

0:00:59

0:14:15

0:14:15

0:05:38

0:05:38

0:13:37

0:13:37

0:10:27

0:10:27

0:19:06

0:19:06

0:05:05

0:05:05

0:09:18

0:09:18

0:00:45

0:00:45

0:14:47

0:14:47

0:09:11

0:09:11

0:00:52

0:00:52

0:11:01

0:11:01

0:00:19

0:00:19

0:07:48

0:07:48

0:19:53

0:19:53

0:13:00

0:13:00

0:00:20

0:00:20

0:00:21

0:00:21

0:13:21

0:13:21

0:00:09

0:00:09

0:07:27

0:07:27

0:00:35

0:00:35

0:05:14

0:05:14