filmov

tv

Replacing taxes with tariffs: Breaking down Trump's tariff-for-tax cuts plan

Показать описание

Jason Furman, Harvard’s Kennedy School of Government economics professor and former CEA chairman, and EJ Antoni, Heritage Foundation economist, join 'Squawk Box' to discuss former President Trump's tax plan, replacing taxes with tariffs, impact on the economy, and more.

Replacing taxes with tariffs: Breaking down Trump's tariff-for-tax cuts plan

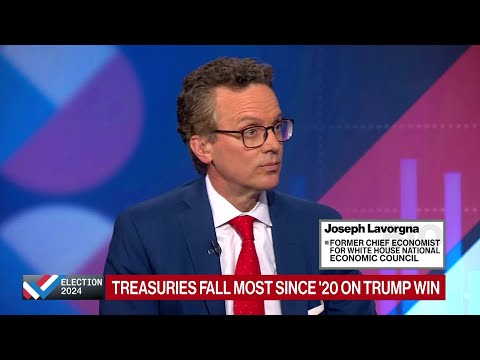

Trump Economist on Tariffs and Tax Cuts in Second Term

Trump's idea of replacing income tax with tariffs is 'impossible mathematically,' ana...

Breaking down Trump's 'tariffs-for-tax cuts' plan

Why Economists Hate Trump's Tariff Plan | WSJ

Donald Trump reiterates US tariff plans | BBC News

'No More Income Taxes!' - The 10% Trump Tariff Explained

Trump proposes to replace income taxes with steep tariffs | Reality Check

Election Insights | Can Trump's Tariffs Really Replace the Income Tax?

Trump proposes replacing income tax with an all-tariff policy

What Trump's tariffs mean for Americans' buying power

Trump’s zero taxes ‘all-tariff’ idea would cost Americans: Expert

Can Trump get rid of income tax and replace revenue with tariffs?

How Trump Plans To Lower Corporate Taxes to 15%

How Would Donald Trump Replace Income Taxes with Tariffs? | CountyOffice.org

Trump Wildly Implies Tariffs Could Replace Income Tax

Trump threatens 100% tariffs on BRICS nations over effort to replace dollar

Trump’s Tariff Plan Explained: Destroy or Help The US Economy?

Trump Tariffs Explained: The 10% Tax on All Imports

Will Trump's Tariffs RAISE Prices? 😬

Trump Threatens 100% Tariffs on Chinese Cars Made in Mexico

Trump's tariffs-for-tax cuts plan: Who stands to benefit?

Donald Trump On Tax Loophole: I Absolutely Used It | CNBC

Trump Won. How Your Taxes Could Change #trumptaxes #trumptaxplan

Комментарии

0:06:28

0:06:28

0:03:57

0:03:57

0:03:05

0:03:05

0:03:38

0:03:38

0:08:18

0:08:18

0:03:54

0:03:54

0:14:41

0:14:41

0:02:45

0:02:45

0:18:31

0:18:31

0:03:31

0:03:31

0:02:35

0:02:35

0:00:54

0:00:54

0:08:07

0:08:07

0:00:29

0:00:29

0:03:46

0:03:46

0:05:36

0:05:36

0:02:58

0:02:58

0:14:06

0:14:06

0:15:11

0:15:11

0:00:44

0:00:44

0:00:16

0:00:16

0:07:29

0:07:29

0:02:26

0:02:26

0:00:59

0:00:59