filmov

tv

Bond Convexity and Duration | Convexity explained with example | FIN-Ed

Показать описание

#fin-ed

Bond Convexity and Duration | Convexity explained with example | FIN-Ed

In this video, we are going to discuss what the convexity of a bond is and how it affects the interest rate risk of a bond.

We know that duration is a key tool in bond portfolio management. Yet, the duration rule for the impact of interest rates on bond prices is only an approximation. One reason is that the duration assumes that the percentage price change is directly proportional to the change in bond‘s yield. In reality, the price-yield line is not straight, but convex. Hence, convexity refers to the curvature of the price-yield relationship of a bond.

Thanks for watching ...!!!

Bond Convexity and Duration | Convexity explained with example | FIN-Ed

In this video, we are going to discuss what the convexity of a bond is and how it affects the interest rate risk of a bond.

We know that duration is a key tool in bond portfolio management. Yet, the duration rule for the impact of interest rates on bond prices is only an approximation. One reason is that the duration assumes that the percentage price change is directly proportional to the change in bond‘s yield. In reality, the price-yield line is not straight, but convex. Hence, convexity refers to the curvature of the price-yield relationship of a bond.

Thanks for watching ...!!!

Bond Duration and Bond Convexity Explained

Calculate Bond Convexity and Duration in Excel | Interest Rate Risk

Bond Convexity and Duration | Convexity explained with example | FIN-Ed

How 'Convexity' Impacts Bond Yields

Bond Duration Explained Simply In 5 Minutes

CFA Level I Fixed Income - Approximate Modified Duration and Convexity Adjustment

Bond Duration And Convexity Concept & Question (Nov 20 Exam / May 23 RTP)

Bond duration and convexity | Understand FINANCE in 2 minutes

Explaining Convexity, Lecture 024, Securities Investment 101, Video 00027

Duration and convexity explained: bond interest rate sensitivity (Excel)

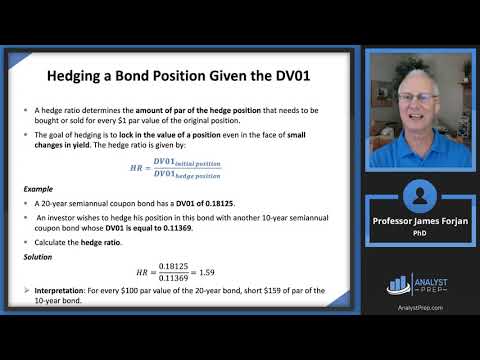

Applying Duration, Convexity, and DV01 (FRM Part 1 2025 – Book 4 – Chapter 12)

Fixed Income: Duration plus convexity to approximate bond price change (FRM T4-38)

Duration and Convexity

FinMod 10 Bond Value YTM Duration Convexity VaR

Calculation of duration and convexity of a zero coupon bond

Duration and convexity

Convexity and Interest Rate Risk

Basics of Fixed Income Securities | Duration and Convexity | CFA Level I Fixed Income|MBA in Finance

CFA level I: Fixed Income - Super Simplyfied Modified Duration Explained

Bond Convexity Definition

Harley Bassman Explains Convexity in Simple Terms

Convexity

What Is Convexity?

Bond Convexity - CA/CMA Final SFM - Advanced Strategic Financial Management

Комментарии

0:09:18

0:09:18

0:11:03

0:11:03

0:03:34

0:03:34

0:01:14

0:01:14

0:05:07

0:05:07

0:09:53

0:09:53

0:44:42

0:44:42

0:02:17

0:02:17

0:04:35

0:04:35

0:20:11

0:20:11

0:45:33

0:45:33

0:19:17

0:19:17

0:22:57

0:22:57

0:44:51

0:44:51

0:00:16

0:00:16

0:08:37

0:08:37

0:10:34

0:10:34

0:20:42

0:20:42

0:14:33

0:14:33

0:01:31

0:01:31

0:00:50

0:00:50

0:07:45

0:07:45

0:03:14

0:03:14

0:35:55

0:35:55