filmov

tv

Possible turning point for the insurance crisis in Florida

Показать описание

For the first time in year insurance companies are dropping rates and new companies are setting up shop in the state. But will it stick? Nadeen Yanes has been covering the insurance industry in Florida for month and has a look at the possible turning point.

Possible turning point for the insurance crisis in Florida

WATCH: Trump speaks at Turning Point USA event summit | LiveNOW from FOX

LIVE: Donald Trump speaks at Turning Point summit in Florida

Turning Points of Polynomial Functions

A Possible Turning Point As Ukraine Makes Gains Against Russia | The Mehdi Hasan Show

Possible turning point as Ukrainian troops drive Russian forces back

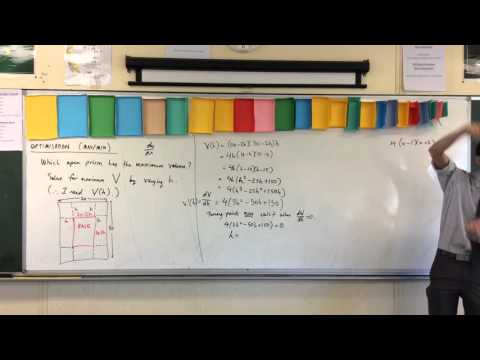

Optimisation (2 of 3: Using the Derivative to find possible turning points)

Determine maximum number of turning points for a polynomial function.

WATCH LIVE: Trump speaks at Turning Point Action summit in Florida

Maximum number of turning points for polynomial functions

Locating Turning Points Using Calculus

Polynomial Graphing - Turning Points

Possible Turning Point In Mueller Probe

Turning Points

Watch live: Trump speaks at ‘The Believers’ Summit’

Polynomial Functions: Turning Points

Turning Points and X Intercepts of a Polynomial Function

Our Own Way - Turning Point

Graphs - Turning Points of Quadratic Graphs Through Factorising

Ferguson Protests Reach Possible 'Turning Point'

Automatic movie analysis and summarization via turning point | Amazon Science

A Turning Point Mystery (1 of 2: Introducing the problem)

LIVE: Trump speaks at Turning Point summit in Florida

Geoffrey Hinton sees now as a turning point in AI #shorts

Комментарии

0:07:41

0:07:41

0:58:18

0:58:18

1:05:06

1:05:06

0:02:17

0:02:17

0:10:33

0:10:33

0:02:14

0:02:14

0:09:32

0:09:32

0:05:25

0:05:25

1:08:06

1:08:06

0:04:16

0:04:16

0:09:43

0:09:43

0:07:26

0:07:26

0:00:58

0:00:58

0:06:02

0:06:02

1:07:49

1:07:49

0:11:24

0:11:24

0:05:32

0:05:32

0:07:24

0:07:24

0:04:37

0:04:37

0:01:53

0:01:53

0:37:33

0:37:33

0:11:48

0:11:48

0:35:20

0:35:20

0:00:39

0:00:39