filmov

tv

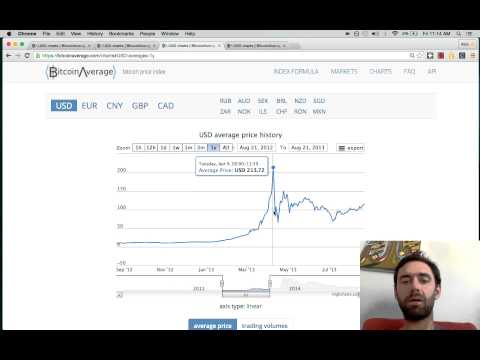

Don't Buy Bitcoin With Cash App - Try This Instead

Показать описание

3 Reasons not to use cash app for buying or holding bitcoin.

Disclaimer: This is not financial advice. This is just an experiment for entertainment purposes only.

Disclaimer: This is not financial advice. This is just an experiment for entertainment purposes only.

Cash App Bitcoin Warning - Watch Before Buying Bitcoin on Cash App

This guy bought #bitcoin at $1 😳 🥳 #btc #crypto #cryptocurrency #davincij15

You Have 51 Days Left To Buy Crypto

Don't buy Bitcoin to MAKE money, buy Bitcoin because it IS money

Don't Buy Bitcoin. It's Going To Crash!!!

ANDREW TATE SAYS THIS ABOUT CRYPTO FUTURE #shorts

DON'T BUY BITCOIN TODAY!

🤫 No KYC Bitcoin: How To Buy Bitcoin PRIVATELY

Seriously... Just Buy Bitcoin- Not Financial Advice

Buy Bitcoin Before The US Gov. Does [$250K BTC Is Programmed]

Cryptocurrency Will Never Be Real Money

How To Buy Bitcoin On Cash App And Send To Another Wallet | Step By Step

Altcoins Are About To EXPLODE!

I’m Buying These 20 ALTCOINS Right Now !

Elon Musk 'I love Dogecoin, but DON'T buy it!'

3 Reasons NOT to Buy Bitcoin Using Robinhood (AUTOMATIC LOSS!)

Asking Bitcoin millionaires how many Bitcoin they own…

How to Use a Bitcoin ATM - ChainBytes

You have NO IDEA how dangerous this crypto wallet is!!!

Altcoins Are About To EXPLODE ! Top Alt Coins To Buy Now - Don't Miss Out

Do NOT buy Crypto on Revolut (Quick Warning)

How To Buy Crypto Under 18 With Debit Card (STILL WORKS 2024)

Bitcoin Cash Explained In Under 60 Seconds

Cryptocurrency Is About To EXPLODE!

Комментарии

0:02:19

0:02:19

0:00:15

0:00:15

0:13:49

0:13:49

0:09:05

0:09:05

0:00:56

0:00:56

0:00:34

0:00:34

0:30:28

0:30:28

0:22:52

0:22:52

0:15:08

0:15:08

0:46:42

0:46:42

0:09:26

0:09:26

0:01:46

0:01:46

0:11:15

0:11:15

0:08:10

0:08:10

0:01:00

0:01:00

0:06:49

0:06:49

0:00:37

0:00:37

0:00:46

0:00:46

0:00:52

0:00:52

0:08:57

0:08:57

0:05:04

0:05:04

0:01:18

0:01:18

0:00:52

0:00:52

0:08:50

0:08:50