filmov

tv

Can I use these two index funds for retirement instead of Nifty, Nifty Next 50?

Показать описание

LET & MAKE | How to Use These Two English Verbs | Verb Patterns

Satan Is POWERLESS Against These TWO WEAPONS! (Use Them Immediately)

You can go left or right if you use these two types of skills👍🔥#shorts #football #soccer

Satan is POWERLESS Against These TWO WEAPONS! (Use Them Immediately)

'You need to collect two notebooks before you can use these doors.' (Baldi Voice Lines)

You famously can’t use these two words

Use Two Notebooks, Change Your Life

Minato and Kakashi edit 🔥🥶 #naruto #shorts

Why Nobody Will Use the Strongest Pokemon Ever

⚠️ Never Use These Two Nozzles at Same Time!

Make and Do - how to use these two verbs correctly in English - Level 1

Greek vocabulary lesson: How to use the two Greek words ''ανάμεσα'' and '&...

open pores | open pores treatment by dermatologist | niacinamide | retinol

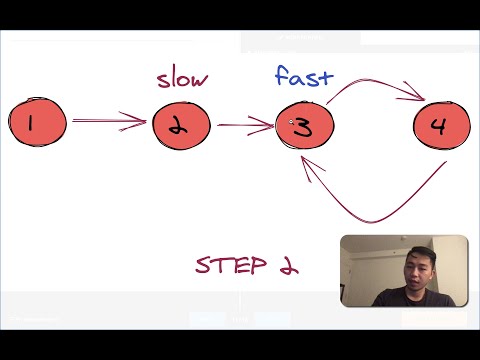

How to Use the Two Pointer Technique

USE THESE TWO INGREDIENTS TO GET THE PERFECT BRIGHTENING TONER

How do you plan to use these two wheels? #automobile #mudtools #machine #wood #automachine

The Two Most Powerful Words! ( Use With Caution!)

Can I use these two index funds for retirement instead of Nifty, Nifty Next 50?

Unbelievable Tool wchich is Use for the Two plates joined together #shorts #welding #tools #amazing

Why Musashi Taught the Two-Katana Style He Didn't Use #Shorts

Use these two great tips when working with resin.

Madara could never think that these two can match for him ☠️ #naruto #narutoshippuden #anime #shorts...

#372 How to use the two Cores of the Pi Pico? And how fast are Interrupts?

SO and ANYWAY. Learn how to use these two very important words in advanced English

Комментарии

0:04:15

0:04:15

0:18:22

0:18:22

0:00:05

0:00:05

0:13:14

0:13:14

0:00:06

0:00:06

0:00:53

0:00:53

0:07:20

0:07:20

0:00:52

0:00:52

0:20:50

0:20:50

0:00:38

0:00:38

0:05:05

0:05:05

0:03:21

0:03:21

0:00:19

0:00:19

0:10:56

0:10:56

0:04:06

0:04:06

0:00:07

0:00:07

0:05:24

0:05:24

0:08:28

0:08:28

0:00:26

0:00:26

0:01:00

0:01:00

0:01:51

0:01:51

0:00:23

0:00:23

0:14:25

0:14:25

0:08:30

0:08:30