filmov

tv

Reversing Runaway Inequality: Financialization

Показать описание

Citizen Action of New York will be releasing a series of short animated videos based on research and findings from Les Leopold’s 2015 book Runaway Inequality. This video provides a brief history of financialization in the United States and the growing popularity of stock buybacks.

Reversing Runaway Inequality: Financialization

Reversing Runaway Inequality: Racial Capitalism

Reversing Runaway Inequality: Better Business Climate

Financialization & Runaway Inequality

Reversing Runaway Inequality | CWA Video

Reversing RUNAWAY INEQUALITY- LES LEOPOLD

Eldridge & Co. - Les Leopold: 'Runaway Inequality'

Money as a Democratic Medium | Financialization and Inequality

Bob Herbert's Op-Ed.TV: Les Leopold on the Causes of Runaway Inequality

Runaway Inequality Trailer

Les Leopold's Runaway Inequality Talk

Why the Trends of Income Inequality & Redistribution of Wealth Could Reverse (w/ Trevor Noren)

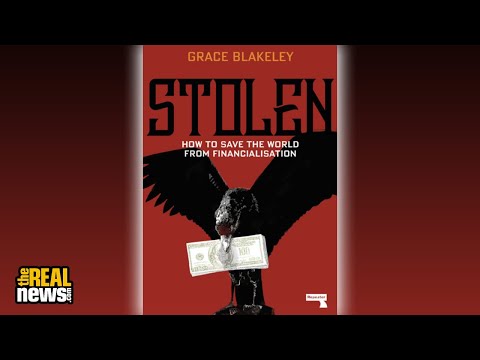

How to Save the World from Financialization

The Financialization and Gamification of the Economy

What is Financialisation?

What Solutions To Inequality Might Look Like - Les Leopold Part Four

What Happened to the American Dream? A Discussion with Les Leopold about Runaway Inequality

Les Leopold's Runaway Inequality Talk, Staten Island United

From Posting to Politics & Runaway Inequality w/ Les Leopold | Jacobin Show

Runaway Inequality Update Third Edition An Activist's Guid To ECONOMICS JUSTICE

Les Leopold: Runaway Inequality, Labor and COVID-19 | Eldridge & Co.

What’s financialization & how does Wall Street affect our lives?

Financialization: Banker Invasion? (w/ Mike Konczal)

Anna Echterhoelter: Financialization as a Parody

Комментарии

0:03:51

0:03:51

0:04:22

0:04:22

0:03:44

0:03:44

0:33:13

0:33:13

0:04:15

0:04:15

0:40:23

0:40:23

0:28:39

0:28:39

1:29:03

1:29:03

0:26:47

0:26:47

0:00:40

0:00:40

0:47:26

0:47:26

0:22:18

0:22:18

0:19:50

0:19:50

0:08:13

0:08:13

0:01:56

0:01:56

0:05:28

0:05:28

1:20:26

1:20:26

0:47:26

0:47:26

1:49:26

1:49:26

1:09:45

1:09:45

0:26:44

0:26:44

0:05:27

0:05:27

0:18:27

0:18:27

0:12:42

0:12:42