filmov

tv

Everything you need to know about filing taxes in Canada💰🇨🇦

Показать описание

In this video, I'll tell you everything you need to know about filing taxes in Canada. I'll share when and where to file taxes, tax deadlines you need to be aware of, tax forms, and much more! One of the requirements to become a Canadian citizen is to file your taxes, so don't miss it out.

// get your questions answered

// socials

// my gear

// timecodes

00:00 First thing to do before filing taxes

01:57 Tax deadlines

02:55 How to file taxes in Canada

04:43 Tips & tricks about filing taxes

08:00 How to maximize your tax return

// disclaimer

The information found on this YouTube Channel and the resources available for download/viewing through this YouTube Channel are for educational and informational purposes only.

Links included in this description might be affiliate links. if you purchase a product or service with the links that I provide I may receive a small commission that will help me to grow my channel. thank you for your support! ♥

// get your questions answered

// socials

// my gear

// timecodes

00:00 First thing to do before filing taxes

01:57 Tax deadlines

02:55 How to file taxes in Canada

04:43 Tips & tricks about filing taxes

08:00 How to maximize your tax return

// disclaimer

The information found on this YouTube Channel and the resources available for download/viewing through this YouTube Channel are for educational and informational purposes only.

Links included in this description might be affiliate links. if you purchase a product or service with the links that I provide I may receive a small commission that will help me to grow my channel. thank you for your support! ♥

This is EVERYTHING YOU NEED to Know About Cars

8 Important Things You Should Know About Yourself

Everything You Need to Know About the Iran–Israel Conflict (Explained Clearly) By Milton Allimadi

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

Here is Everything We Don't Know (Extended)

becoming smart is easy, actually

Microeconomics- Everything You Need to Know

Everything You Need to Know Before Watching Thunderbolts: The New Avengers- Marvel RECAP

Everything You Need to Know About Trading 212 Pies

Everything YOU Need to Know About T1 for MSI 2025

20 Things Most People Learn Too Late In Life

Israel-Iran War: EVERYTHING You Need to Know (Q&A)

Top 100 Facts That Might Save Your Life One Day

Everything you need to know before training calisthenics (at home no weights)

Terraria x Palworld - Everything You Need To Know

Macroeconomics- Everything You Need to Know

BMW M3 - Everything You Need to Know | Up to Speed

U.S. BOMBS IRAN! Everything You Need To Know About The U.S. STRIKE On FORDOW Nuclear Facility

Everything You Need to Know About Seeing in the Spirit

Everything You NEED To KNOW To TRAIN Your DOG!

Everything We Don't Know

Everything You Need to Know About Fasting // How to Fast Step by Step

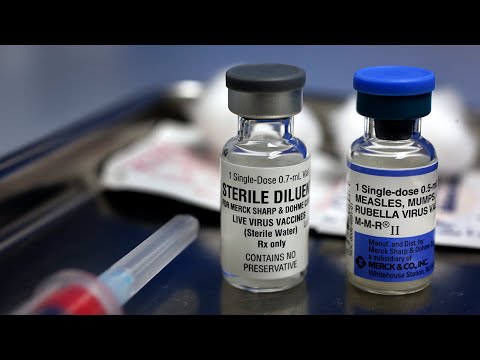

Everything You Need to Know (And Forget) About Vaccines

Everything You Need to Know About Prayer and Fasting

Комментарии

0:11:57

0:11:57

0:06:27

0:06:27

0:06:25

0:06:25

0:43:57

0:43:57

3:01:58

3:01:58

0:07:33

0:07:33

0:28:55

0:28:55

0:26:58

0:26:58

0:12:16

0:12:16

0:09:32

0:09:32

0:07:38

0:07:38

0:57:15

0:57:15

0:26:07

0:26:07

0:11:04

0:11:04

0:05:34

0:05:34

0:29:58

0:29:58

0:10:14

0:10:14

0:14:19

0:14:19

1:06:30

1:06:30

2:49:16

2:49:16

0:14:05

0:14:05

0:33:04

0:33:04

0:33:24

0:33:24

1:15:58

1:15:58