filmov

tv

Option Trading Volatility Strategies To Make Easy Money

Показать описание

----------------------------

𝐋𝐞𝐠𝐚𝐥 𝐃𝐢𝐬𝐜𝐥𝐨𝐬𝐮𝐫𝐞: I’m not a financial advisor. The information contained in this video is for entertainment purposes only. Before investing, please consult a licensed professional. Any stock purchases I show on video should not be considered “investment recommendations”. I shall not be held liable for any losses you may incur for investing and trading in the stock market in an attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely. Please be careful!

𝐋𝐞𝐠𝐚𝐥 𝐃𝐢𝐬𝐜𝐥𝐨𝐬𝐮𝐫𝐞: I’m not a financial advisor. The information contained in this video is for entertainment purposes only. Before investing, please consult a licensed professional. Any stock purchases I show on video should not be considered “investment recommendations”. I shall not be held liable for any losses you may incur for investing and trading in the stock market in an attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely. Please be careful!

OPTIONS TRADING BASICS | Implied Volatility Explained EASY TO UNDERSTAND

Volatility Trading: The Market Tactic That’s Driving Stocks Haywire | WSJ

Mastering Implied Volatility: What Options Traders Need to Know

Option Trading Volatility Strategies To Make Easy Money

My favorite options strategy for high volatility

Quick Guide To Trading Volatility With Options [Episode 180]

How to Trade Volatility in Under 4 Minutes

Implied Volatility Explained (The ULTIMATE Guide)

Advanced Strategies with Options

Why You Should Use Implied Volatility to Buy and Sell Options

Master Volatility Options Trading with Dr. Euan Sinclair | Advanced Strategies Explained

Unleashing the Power of Implied Volatility in Options Trading

Understanding Vega: How Volatility Impacts Options Trading 📈📉

Implied Volatility For Options Trading (2024 ULTIMATE Guide)

Implied Volatility Trading Guide 2024

Implied Volatility (IV) Explained: Complete Guide For Option Traders 💯

Volatility Arbitrage - How does it work? - Options Trading Lessons

Trading VIX Options: Top 3 Things to Know | Volatility Trading

Implied volatility in option trading ,Iv in option trading #stockmarket #trading #options #shorts

Volatility Index (india vix)#trading #volatility #youtubeshorts #daytrading #viral

I Found The Market Structure Strategy That Will Make You $$$ (2025 Guide)

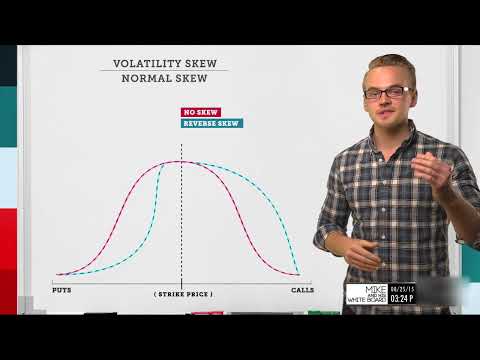

Volatility Skew Explained | Options Trading Concepts

What is volatility?

What is Volatility?

Комментарии

0:08:14

0:08:14

0:04:39

0:04:39

0:15:13

0:15:13

0:21:05

0:21:05

0:00:48

0:00:48

0:04:06

0:04:06

0:03:45

0:03:45

0:29:50

0:29:50

1:00:16

1:00:16

0:07:43

0:07:43

1:02:21

1:02:21

0:00:25

0:00:25

0:00:49

0:00:49

0:30:35

0:30:35

0:22:00

0:22:00

0:28:02

0:28:02

0:14:11

0:14:11

0:16:33

0:16:33

0:01:00

0:01:00

0:00:37

0:00:37

0:20:00

0:20:00

0:10:43

0:10:43

0:01:23

0:01:23

0:00:35

0:00:35