filmov

tv

Impact of Portfolio Return on Your Roth Conversion Strategy (Surprising)

Показать описание

Timestamps:

0:00 How Much Does Growth Rate Affect Roth Conversions?

0:13 The Main Catalyst For Roth Conversions

1:19 Why You Will Have an Increasing RMD...

2:30 The Wide Dispersion of Portfolio Returns

4:02 Case Study: Benchmark Example

6:17 RMD Growth in a "Normal" Environment

7:57 RMD Growth in Higher/Lower Return Environments

8:40 Optimal Roth Conversion Strategy Based on Growth Rate

11:19 Additional Context: Does Portfolio Return Matter?

- - - - - - - - - - - - - - - - - - - - - - - - -

Always remember, "You Don't Need More Money; You Need a Better Plan"

Impact of Portfolio Return on Your Roth Conversion Strategy (Surprising)

Worried About Market Performance? Here's How It Really Effects Your Portfolio as You Near Retir...

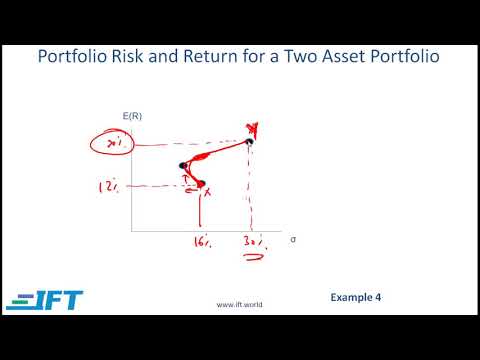

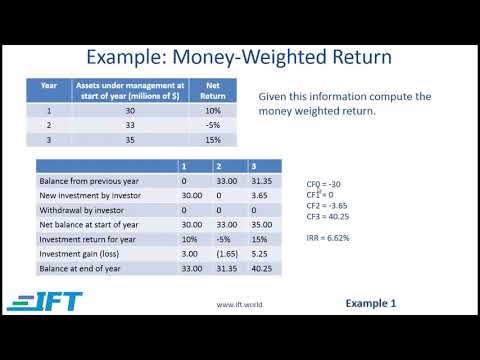

Portfolio Risk and Return - Part I (2024/2025 Level I CFA® Exam – PM – Module 1)

Risk & Return (2 of 7)- Portfolio Diversification

Portfolio attribution

Maximize Returns Through Portfolio Rebalancing

FX Impact On Your Trading 212 Investment Portfolio! (FOREX Could Be Hurting Your Returns!)

Warren Buffett's Advice for Investors in 2025

Understanding The Dangers Of Trusting Past Returns | Expert Strategy To Choose Funds| The Money Show

Portfolio Diversification and Optimisation

Mastering Multi-Asset Portfolio Analysis: Standard Deviation & Returns in Excel

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 3

Concentrated Portfolio is a Disaster...? | Mohnish Pabrai | Stocks | Investment | Diversification

Portfolio Risk and Return – Part II (2024/2025 Level I CFA® Exam – PM – Module 2)

BEST 3 ETF PORTFOLIO taking over the world (so simple $$$)

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 1

How do lower interest rates impact a portfolio?

Impact of Stock Failures on Your Portfolio and Index Funds

Best Social Security Strategy Based on Portfolio Return? (Most Get This Wrong)

Exploring the Impact of a Commodity Allocation on Your Portfolio

MBA FIN11 2 MPT - Portfolio Weights

Ken Fisher, Discusses the Right Time to Do a Portfolio Review

Investing for Change: The “Total Impact” Portfolio

Jack Bogle: 'Never' Rebalance Your Investment Portfolio (and how to do it if you must)

Комментарии

0:13:41

0:13:41

0:12:55

0:12:55

0:55:39

0:55:39

0:20:04

0:20:04

0:06:12

0:06:12

0:16:26

0:16:26

0:09:46

0:09:46

0:17:50

0:17:50

0:18:27

0:18:27

0:19:52

0:19:52

0:14:34

0:14:34

0:15:21

0:15:21

0:04:42

0:04:42

0:54:59

0:54:59

0:00:39

0:00:39

0:30:40

0:30:40

0:00:41

0:00:41

0:00:54

0:00:54

0:13:11

0:13:11

0:10:53

0:10:53

0:15:48

0:15:48

0:00:56

0:00:56

0:59:31

0:59:31

0:21:12

0:21:12