filmov

tv

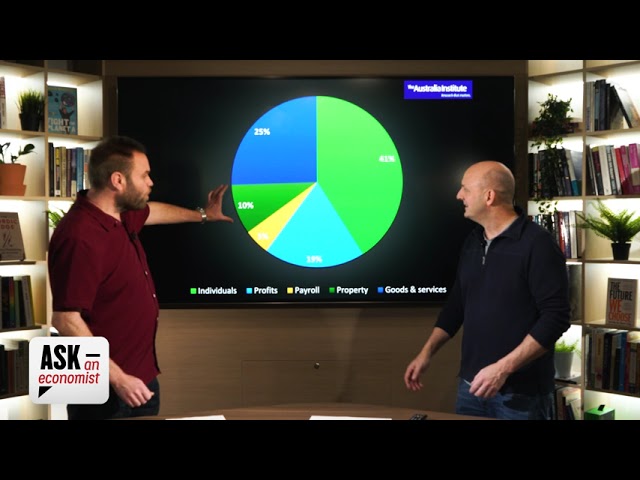

What the stage 3 tax cuts will mean for the economy | Ask an Economist

Показать описание

In this episode, Richard and Matt answer the question: "The Labor Party has announced they are dumping their proposed reforms of negative gearing and the capital gains tax discount, and they are now saying they will not repeal the stage 3 tax cuts. What will it mean for the economy?"

Welcome to Australia Institute's Ask an Economist -- with Matt Grudnoff, senior economist at the Australia Institute, and Richard Denniss, chief economist at the Australia Institute.

*****

The Australia Institute relies on the generosity of people who care about research that matters. All donations to our Research Fund help support the Australia Institute’s original research that contributes to a more just, sustainable and peaceful society. Every donation you make of $2 or more is tax-deductible (Australia).

Welcome to Australia Institute's Ask an Economist -- with Matt Grudnoff, senior economist at the Australia Institute, and Richard Denniss, chief economist at the Australia Institute.

*****

The Australia Institute relies on the generosity of people who care about research that matters. All donations to our Research Fund help support the Australia Institute’s original research that contributes to a more just, sustainable and peaceful society. Every donation you make of $2 or more is tax-deductible (Australia).

Stage 3 tax cuts explained: Who are the winners and losers? | ABC News

Who gets what under the rewritten Stage 3 tax cuts? | ABC News

Labor AMENDS Stage 3! What it means for you...

What the stage 3 tax cuts will mean for the economy | Ask an Economist

What are the stage 3 tax cuts? | Video Lab | ABC News In-depth

Stage 3 Tax Cuts are Unfair

Stage 3 Tax Cuts and the Cost of Living | Q+A

Stage 3 tax cuts: How much money will you get?

Prime Minister shakes up stage 3 tax cuts | 9 News Australia

What the ‘stage 3 tax cuts’ mean for you | ABC News Daily Podcast

Government to overhaul stage 3 tax cuts | ABC News

Stage 3 tax cuts are a bad fix for Bracket Creep

Opposition to support Government's Stage 3 tax cut reforms | ABC News

PM hints at expansion of stage 3 tax cuts to benefit lower-income earners | ABC News

Stage 3 Tax Cuts are a Terrible Idea | Off the Charts with Greg Jericho

Stage 3 tax cut stance remains unchanged says Treasurer | ABC News

Anthony Albanese's stage three tax cut changes explained | 9 News Australia

No Change to Stage 3 Tax Cuts | Q+A |

Stage-three tax cuts: what's changed and how we got here

Stage 3 Tax Cuts | Q+A |

Stage 3 tax cuts in the spotlight as parliament returns | 7.30

Who Benefits from the Stage 3 Tax Cuts? | Greg Jericho on the Drum

Angus Taylor is Wrong About Stage 3 Tax Cuts | Spin Bin

Q+A | No Change to Stage 3 Tax Cuts

Комментарии

0:07:28

0:07:28

0:03:00

0:03:00

0:01:41

0:01:41

0:09:10

0:09:10

0:07:22

0:07:22

0:00:31

0:00:31

0:09:53

0:09:53

0:12:18

0:12:18

0:02:24

0:02:24

0:12:23

0:12:23

0:03:37

0:03:37

0:01:42

0:01:42

0:02:47

0:02:47

0:01:52

0:01:52

0:02:34

0:02:34

0:02:13

0:02:13

0:08:34

0:08:34

0:01:00

0:01:00

0:03:04

0:03:04

0:09:51

0:09:51

0:06:24

0:06:24

0:03:36

0:03:36

0:11:11

0:11:11

0:01:00

0:01:00