filmov

tv

ALWAYS Pay Your Credit Card On This Date! | INCREASE CREDIT SCORE FAST

Показать описание

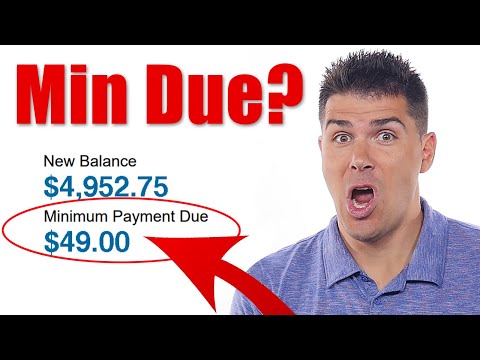

Knowing when to pay your credit card bill and how to pay your credit card bill can seem a little bit like a game of chess (chess B Roll). If you make the wrong move, you can find yourself “losing” at the credit score game. If you make the mistake I’ve made, just a few times, you can even potentially see your credit score drop several points. My score in particular dropped over 20 points temporarily after making this mistake, and that is nearly the same impact as opening a new credit card account. So understanding your credit card statement is very important. As we watch this video, I want you guys to understand 3 things. Statement Closing Date, Payment Due Date, and Grace Period. Let’s get a quick definition of all 3 of those terms, but before we get into that, as you watch this video and if you find the information helpful, consider hitting that like button for the youtube algorithm, subscribing for more videos like this from myself, and hitting that notification bell so you don’t miss any future videos.

-------------------------------------------------------------------------------------------------------------------------

💰💰 Save 5% on Ekster products:

Discount Code: CJ

If you’re thinking about getting a new credit card and want to support the channel, consider using one my referral links below:

💳 Bilt Mastercard:

💳 Chase Ink Cards:

💳 Chase Freedom Cards:

💳 Chase Sapphire Preferred:

Disclaimer:

The content in this video is accurate as of the posting date. Offers change frequently and those mentioned may no longer be available. CJ is not a financial advisor or financial professional. This video is for entertainment and educational purposes only. Please always consult with a financial advisor and do your own due diligence.

Advertiser Disclosure: Some of the links and products that appear in this description section are from companies which I will earn an affiliate commission or referral bonus. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This video does not review or include all companies or all available products. The above references an opinion and is for information purposes only.

-------------------------------------------------------------------------------------------------------------------------

💰💰 Save 5% on Ekster products:

Discount Code: CJ

If you’re thinking about getting a new credit card and want to support the channel, consider using one my referral links below:

💳 Bilt Mastercard:

💳 Chase Ink Cards:

💳 Chase Freedom Cards:

💳 Chase Sapphire Preferred:

Disclaimer:

The content in this video is accurate as of the posting date. Offers change frequently and those mentioned may no longer be available. CJ is not a financial advisor or financial professional. This video is for entertainment and educational purposes only. Please always consult with a financial advisor and do your own due diligence.

Advertiser Disclosure: Some of the links and products that appear in this description section are from companies which I will earn an affiliate commission or referral bonus. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This video does not review or include all companies or all available products. The above references an opinion and is for information purposes only.

Комментарии

0:08:04

0:08:04

0:14:44

0:14:44

0:15:28

0:15:28

0:08:09

0:08:09

0:11:09

0:11:09

0:08:45

0:08:45

0:04:41

0:04:41

0:05:49

0:05:49

0:22:46

0:22:46

0:00:30

0:00:30

0:02:55

0:02:55

0:00:58

0:00:58

0:02:01

0:02:01

0:16:15

0:16:15

0:07:51

0:07:51

0:10:13

0:10:13

0:06:33

0:06:33

0:07:48

0:07:48

0:04:07

0:04:07

0:05:32

0:05:32

0:00:59

0:00:59

0:09:43

0:09:43

0:09:00

0:09:00

0:18:56

0:18:56