filmov

tv

Net present value on ba ii plus | NPV | FIN-Ed

Показать описание

#fin-ed

Net present value on ba ii plus | NPV | FIN-Ed

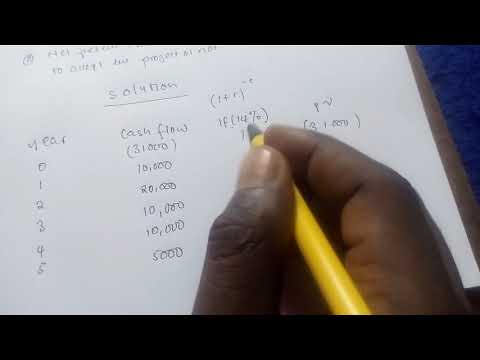

This video is about how to calculate the net present value or NPV using a Texas BA II Plus financial calculator. NPV is a method of ranking investment proposals that is equal to the present value of the project’s free cash flows discounted at the cost of capital.

Example:

Your division is considering two projects with the following cash flows (in millions). If the WACC is 10%, what are the projects’ NPV and which project will you accept?

Source: Fundamentals of Financial Management (Concise Edition) Brigham and Houston

Chapter 11: The Basics of Capital Budgeting

Problem: 11-6

========Recommended Videos=============

========================================

Thanks for watching...!!!

Net present value on ba ii plus | NPV | FIN-Ed

This video is about how to calculate the net present value or NPV using a Texas BA II Plus financial calculator. NPV is a method of ranking investment proposals that is equal to the present value of the project’s free cash flows discounted at the cost of capital.

Example:

Your division is considering two projects with the following cash flows (in millions). If the WACC is 10%, what are the projects’ NPV and which project will you accept?

Source: Fundamentals of Financial Management (Concise Edition) Brigham and Houston

Chapter 11: The Basics of Capital Budgeting

Problem: 11-6

========Recommended Videos=============

========================================

Thanks for watching...!!!

0:02:53

0:02:53

0:05:26

0:05:26

0:08:12

0:08:12

0:02:35

0:02:35

0:04:34

0:04:34

0:02:56

0:02:56

0:03:11

0:03:11

0:01:53

0:01:53

1:56:09

1:56:09

0:02:38

0:02:38

0:03:56

0:03:56

0:03:22

0:03:22

0:03:48

0:03:48

0:07:27

0:07:27

0:03:45

0:03:45

0:03:47

0:03:47

0:04:13

0:04:13

0:08:03

0:08:03

0:04:25

0:04:25

0:03:05

0:03:05

0:04:02

0:04:02

0:09:54

0:09:54

0:01:57

0:01:57

0:07:04

0:07:04