filmov

tv

Linear Regression: Time Series Analysis

Показать описание

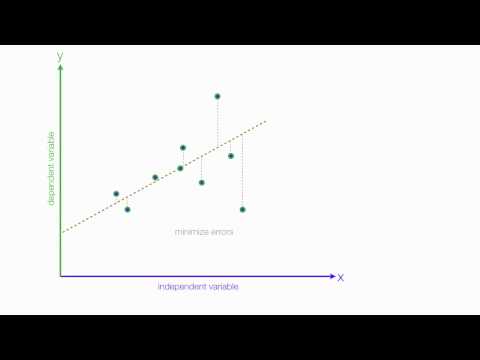

Linear Regression: Time Series Analysis

Hi everyone! This is a quick and simple Time Series: Linear Regression analysis - Output interpretation in Eviews. Learn how to estimate a simple linear regression and how to interpret the linear regression output results - how to estimate and interpret ols!

Summary of the video: Using real GDP data for Argentina and Brazil, I show you how to estimate a linear regression in eviews and how to interpret the regression estimation output. Estimate the linear regression yourself and obtain the linear regression results by downloading the data in the description. I hope you enjoy it!

📈 Download the dataset for free and replicate the content of the video:

✅ Visit my website to see all my FREE tutorials:

☕️ If you value my content and would like to show a recognition, you can make a donation:

---------------------------------------------------------------------------------------------------------

🕘 Timestamps:

🎬 In this video the following analysis is performed:

👋 Video introduction 0:00

📊 (i)How to estimate linear regression in Eviews 1:05

📊 (ii)How to interpret eviews regression output: 1:53

📊 (ii)Regression residuals: 11:30

---------------------------------------------------------------------------------------------------------

🎬 More EViews related videos:

---------------------------------------------------------------------------------------------------------

Doubts or comments? Please leave your comment and I will be pleased to provide you an answer.

👍 Like and subscribe for more videos!

🛎If you would like to contact me for research purposes, or work related issues, please feel to send me a message at:

---------------------------------------------------------------------------------------------------------

Thanks!

Hi everyone! This is a quick and simple Time Series: Linear Regression analysis - Output interpretation in Eviews. Learn how to estimate a simple linear regression and how to interpret the linear regression output results - how to estimate and interpret ols!

Summary of the video: Using real GDP data for Argentina and Brazil, I show you how to estimate a linear regression in eviews and how to interpret the regression estimation output. Estimate the linear regression yourself and obtain the linear regression results by downloading the data in the description. I hope you enjoy it!

📈 Download the dataset for free and replicate the content of the video:

✅ Visit my website to see all my FREE tutorials:

☕️ If you value my content and would like to show a recognition, you can make a donation:

---------------------------------------------------------------------------------------------------------

🕘 Timestamps:

🎬 In this video the following analysis is performed:

👋 Video introduction 0:00

📊 (i)How to estimate linear regression in Eviews 1:05

📊 (ii)How to interpret eviews regression output: 1:53

📊 (ii)Regression residuals: 11:30

---------------------------------------------------------------------------------------------------------

🎬 More EViews related videos:

---------------------------------------------------------------------------------------------------------

Doubts or comments? Please leave your comment and I will be pleased to provide you an answer.

👍 Like and subscribe for more videos!

🛎If you would like to contact me for research purposes, or work related issues, please feel to send me a message at:

---------------------------------------------------------------------------------------------------------

Thanks!

Комментарии

0:02:34

0:02:34

0:06:28

0:06:28

0:07:29

0:07:29

0:12:57

0:12:57

0:24:59

0:24:59

0:13:29

0:13:29

0:12:23

0:12:23

0:03:00

0:03:00

0:26:41

0:26:41

0:42:47

0:42:47

0:12:44

0:12:44

0:04:48

0:04:48

0:11:09

0:11:09

0:23:21

0:23:21

0:07:38

0:07:38

0:08:54

0:08:54

0:15:05

0:15:05

1:16:19

1:16:19

0:09:38

0:09:38

0:07:42

0:07:42

0:23:09

0:23:09

1:22:13

1:22:13

0:06:22

0:06:22

0:05:18

0:05:18