filmov

tv

Is The Capital One Quicksilver Credit Card STILL Worth It?

Показать описание

We're reviewing the Capital One to see if its still worth getting, after 8 years of experience with it!

CREDIT CARD REVIEWS

▶️ Music: @OSRSBeatz

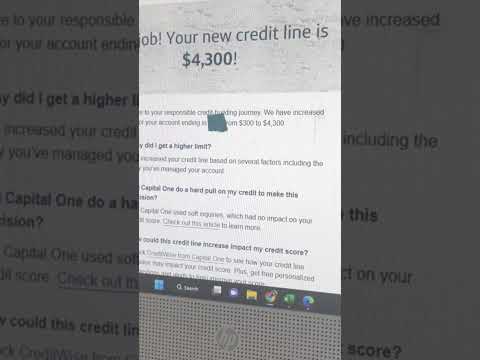

ABOUT: In this video, we will be discussing the Capital One Quicksilver Credit Card, which I have had for over 8 years, and its features. This card offers unlimited 1.5% cashback on all purchases, with no annual fee and a one-time bonus of $200 after spending $500 in the first three months. We will also cover the card's benefits, such as travel accident insurance and extended warranty protection. If you're looking for a straightforward cashback credit card, this one is for you!

#capitalone #quicksilver #review

Title: Is The Capital One Quicksilver Credit Card Still Worth It?

Tags: capital one,capital one review,capital one credit cad,capital one credit cards,capital one quicksilver review,capital one quicksilver credit card,quicksilver credit card,capital one reviews,capital one quicksilver cash rewards credit card review,capital one quicksilver cash rewards credit card,credit card reviews,adam venture finance

Legal Disclosure: I'm not a financial advisor. The information contained in this video is for entertainment purposes only. Before investing, please consult a licensed professional. Any purchases I show on video should not be considered "investment recommendations". I shall not be held liable for any losses you may incur for investing and trading in attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely. Please be careful!

CREDIT CARD REVIEWS

▶️ Music: @OSRSBeatz

ABOUT: In this video, we will be discussing the Capital One Quicksilver Credit Card, which I have had for over 8 years, and its features. This card offers unlimited 1.5% cashback on all purchases, with no annual fee and a one-time bonus of $200 after spending $500 in the first three months. We will also cover the card's benefits, such as travel accident insurance and extended warranty protection. If you're looking for a straightforward cashback credit card, this one is for you!

#capitalone #quicksilver #review

Title: Is The Capital One Quicksilver Credit Card Still Worth It?

Tags: capital one,capital one review,capital one credit cad,capital one credit cards,capital one quicksilver review,capital one quicksilver credit card,quicksilver credit card,capital one reviews,capital one quicksilver cash rewards credit card review,capital one quicksilver cash rewards credit card,credit card reviews,adam venture finance

Legal Disclosure: I'm not a financial advisor. The information contained in this video is for entertainment purposes only. Before investing, please consult a licensed professional. Any purchases I show on video should not be considered "investment recommendations". I shall not be held liable for any losses you may incur for investing and trading in attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely. Please be careful!

Комментарии

0:09:35

0:09:35

0:06:48

0:06:48

0:04:10

0:04:10

0:07:49

0:07:49

0:00:41

0:00:41

0:06:38

0:06:38

0:08:10

0:08:10

0:09:20

0:09:20

0:08:22

0:08:22

0:09:09

0:09:09

0:09:39

0:09:39

0:10:35

0:10:35

0:00:20

0:00:20

0:09:05

0:09:05

0:03:27

0:03:27

0:08:41

0:08:41

0:00:25

0:00:25

0:00:57

0:00:57

0:08:26

0:08:26

0:13:19

0:13:19

0:03:55

0:03:55

0:01:01

0:01:01

0:00:33

0:00:33

0:06:57

0:06:57