filmov

tv

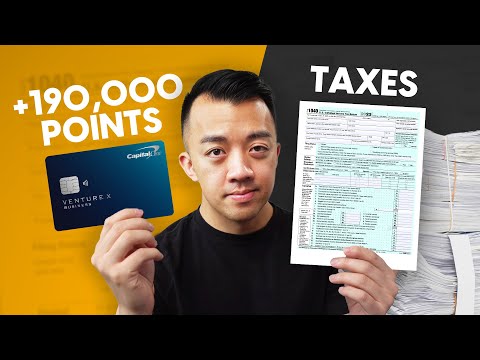

Should You Pay Taxes with Credit Card? 2024

Показать описание

If you are interested in applying for any cards, using my affiliate links below helps support my channel, and I earn a commission if you are approved.

Capital One Venture X

Capital One Venture X Business

Chase Ink Business Preferred

Amex Blue Business Plus

💳 More Credit Card Affiliate Links

🖥 Website

✉️ Max Miles Points Weekly Newsletter

📲 Follow me on Instagram

📲 Follow me on TikTok

Max Miles Points has partnered with CardRatings for our coverage of credit card products. Max Miles Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s and have not been reviewed, endorsed, or approved by any entities.

—

Did you know that the IRS can help you earn credit card points? In this video, we'll go over the fees, possible benefits, and how to calculate if paying taxes with your credit card maximizes your points.

💬 Comment if you have any questions!

📕 Chapters

00:00 Intro

00:24 Fees for Paying Taxes with a Credit Card

01:41 Welcome Bonuses

03:19 Unlock Credit Card Benefits

03:56 Credit Cards to Pay Taxes With

04:11 Personal Credit Cards

05:34 Business Cards

07:06 Additional Tips

07:44 Closing

Capital One Venture X

Capital One Venture X Business

Chase Ink Business Preferred

Amex Blue Business Plus

💳 More Credit Card Affiliate Links

🖥 Website

✉️ Max Miles Points Weekly Newsletter

📲 Follow me on Instagram

📲 Follow me on TikTok

Max Miles Points has partnered with CardRatings for our coverage of credit card products. Max Miles Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s and have not been reviewed, endorsed, or approved by any entities.

—

Did you know that the IRS can help you earn credit card points? In this video, we'll go over the fees, possible benefits, and how to calculate if paying taxes with your credit card maximizes your points.

💬 Comment if you have any questions!

📕 Chapters

00:00 Intro

00:24 Fees for Paying Taxes with a Credit Card

01:41 Welcome Bonuses

03:19 Unlock Credit Card Benefits

03:56 Credit Cards to Pay Taxes With

04:11 Personal Credit Cards

05:34 Business Cards

07:06 Additional Tips

07:44 Closing

Комментарии

0:00:20

0:00:20

0:04:02

0:04:02

0:08:16

0:08:16

0:08:15

0:08:15

0:00:56

0:00:56

0:00:27

0:00:27

0:10:15

0:10:15

0:01:57

0:01:57

0:02:33

0:02:33

0:01:00

0:01:00

0:03:06

0:03:06

0:12:53

0:12:53

0:25:54

0:25:54

0:27:35

0:27:35

0:00:48

0:00:48

0:00:39

0:00:39

0:05:49

0:05:49

0:06:31

0:06:31

0:01:08

0:01:08

0:02:00

0:02:00

0:00:47

0:00:47

0:06:55

0:06:55

0:10:08

0:10:08

0:01:57

0:01:57