filmov

tv

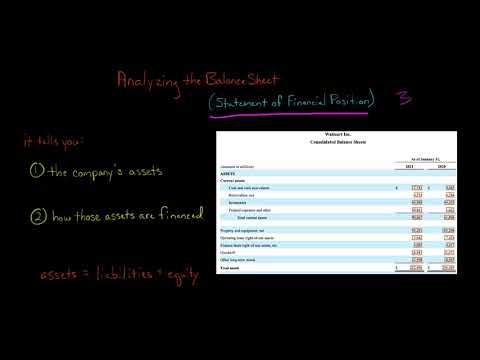

How to Analyze a Balance Sheet Like a Hedge Fund Analyst

Показать описание

This video covers how to analyze a balance sheet like a hedge fund analyst. The balance sheet is one of the key financials statements that investors need to analyze as part of research companies and is an important part of the stock research process.

After watching this video, you will have a better understanding of the following topics: how to analyze a balance sheet, how to read a balance sheet, financial statement analysis, how to research a stock, what is a balance sheet, the income statement, the cash flow statement, and value investing

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more.

How Masterworks works:

-Create your account with crypto wallet or traditional bank account

-Pick major works of art to invest in or our new blue-chip art fund

-Identify investment amount, there is no minimum investment

-Hold shares in works by Picasso or trade them in our secondary marketplace

After watching this video, you will have a better understanding of the following topics: how to analyze a balance sheet, how to read a balance sheet, financial statement analysis, how to research a stock, what is a balance sheet, the income statement, the cash flow statement, and value investing

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more.

How Masterworks works:

-Create your account with crypto wallet or traditional bank account

-Pick major works of art to invest in or our new blue-chip art fund

-Identify investment amount, there is no minimum investment

-Hold shares in works by Picasso or trade them in our secondary marketplace

How To Analyze a Balance Sheet

How To Read & Analyze The Balance Sheet Like a CFO | The Complete Guide To Balance Sheet Analysi...

How to Read and Understand a Balance Sheet (Apple in Review)

How to Analyze a Balance Sheet Like a Hedge Fund Analyst

Common-size Analysis (Vertical Analysis): Balance Sheet

Balance Sheet Analysis In Just 40 Minutes | Balance Sheet Explained

5. Understanding balance sheet

How to READ & ANALYSE Balance Sheet? (w/ Eng. cc) | Fundamental Analysis Part 4

Band Teacher Reaction/Analysis of Dimash Smoke

Principles of the Balance Sheet. A mini crash course with everything you need to know

How to read Balance Sheet of a company | fundamental analysis of stock market

The BALANCE SHEET for BEGINNERS (Full Example)

How to Analyze a Balance Sheet? | Learn with Upstox ft. CA Rachana Ranade

How We Analyze A Bank's Balance Sheet

Balance sheet analysis

How to Read & Analyze a Balance Sheet like a CFO - For Beginners

Balance Sheet - How to Read and Analyze? Learn Fundamental Analysis in Stock Market Ep 16

How to Analyze the Balance Sheet to Pick Stocks

Vertical Analysis of a Balance Sheet | Explained with Example

Relationship between 💵 Income Statement & ⚖️ Balance Sheet

BALANCE SHEET explained

Analyzing the Balance Sheet | Financial Statement Analysis

How to Read Balance Sheet on Moneycontrol? (Hindi) Part 1

All of the Balance Sheet Ratios for Financial Analysts

Комментарии

0:16:19

0:16:19

0:21:32

0:21:32

0:15:36

0:15:36

0:14:26

0:14:26

0:06:01

0:06:01

0:37:10

0:37:10

0:09:21

0:09:21

0:08:57

0:08:57

0:10:56

0:10:56

1:19:24

1:19:24

0:11:01

0:11:01

0:06:59

0:06:59

0:07:02

0:07:02

0:02:28

0:02:28

0:24:44

0:24:44

0:18:11

0:18:11

0:28:41

0:28:41

0:13:57

0:13:57

0:12:49

0:12:49

0:09:17

0:09:17

0:09:10

0:09:10

0:14:22

0:14:22

0:14:17

0:14:17

0:30:13

0:30:13