filmov

tv

PF Deduction From Salary Calculation

Показать описание

PF Deduction From Salary Calculation

PF Deduction From Salary Calculation Video In This Video We Are Explaining Calculation Of PF Deduction From Salary.

PF Deduction From Salary Calculation Video In This Video We Are Explaining Calculation Of PF Deduction From Salary.

PF Deduction From Salary Calculation

EPF (Employee Provident Fund) – Calculation, Rules 2022 | PF Calculation in Hindi | EPF

EPF - Employee Provident Fund Calculator, Interest Rate & Withdrawal Rules Guide 2024

How to Calculate Employee Provident Fund(#EPF) Interest In Excel - #PF calculation in excel

Salary calculation formula in hindi | Salary Calculation in Excel | PF Calculation in Salary

Employee Provident Fund (EPF) Calculations and Deductions with Example | Telugu | PF

How to calculate PF amount in tamil | EPF & EPS calculation |Gen Infopedia EPF helpline service

what is the pf in Tamil and how to salary deducted in pf.full explain video

Why PF is deducted twice from your salary?

Complete Salary Computation in Excel | Payroll calculation in excel

🔴Employee Provident Fund Act (EPF) Calculation🔢

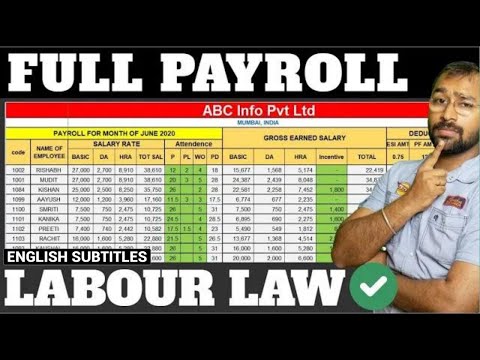

🔴How to make Payroll in Excel for beginners | Payroll Calculation as per Labour Laws

PF and Esi Calculation Excel Sheet 2024 | How To Calculate PF and Esi from Salary 2024 | #esi #epfo

EPF Interest Calculation & Interest Rate | Employee Provident Fund Excel Calculator (Hindi)

Whether all employees having Salary of more than Rs. 15000 required to deduct PF?

PF calculation before filing return | all about PF calculations from Salary statement |Admin charges

EPF (Employee Provident Fund) – Calculation, Withdrawal Rules, Interest Rate

PF Calculation 2022, EPF+EPS Calculation In Hindi🤔PF Kitana Katta He 1800/- Ya 12% #pfcalculation

Calculation of CTC Breakup & Salary Breakup in Excelsheet. #CTCbreakup #shorts #hrcareerinstitut...

How to Calculate PF (EPF & EPS) Amount in Tamil - Webtech

How to Calculate ESI | ESI Calculation In Excel #ESI Calculation - Employee State Insurance Scheme

Take Home Salary Calculation Details in Tamil | What is Basic Pay? | Salary Explanation in Tamil

What is the difference between CTC and Net Salary and Gross Salary? | Ankur Warikoo Hindi Video

Salary Calculation || How to Calculate Net Salary? || HR Tutorials India || How to Calculate Salary?

Комментарии

0:10:31

0:10:31

0:04:04

0:04:04

0:14:54

0:14:54

0:08:25

0:08:25

0:04:17

0:04:17

0:10:34

0:10:34

0:14:21

0:14:21

0:05:11

0:05:11

0:04:16

0:04:16

1:03:25

1:03:25

0:10:03

0:10:03

0:08:55

0:08:55

0:06:04

0:06:04

0:17:26

0:17:26

0:03:08

0:03:08

0:13:25

0:13:25

0:14:13

0:14:13

0:06:55

0:06:55

0:01:00

0:01:00

0:13:47

0:13:47

0:04:31

0:04:31

0:11:00

0:11:00

0:19:10

0:19:10

0:13:18

0:13:18