filmov

tv

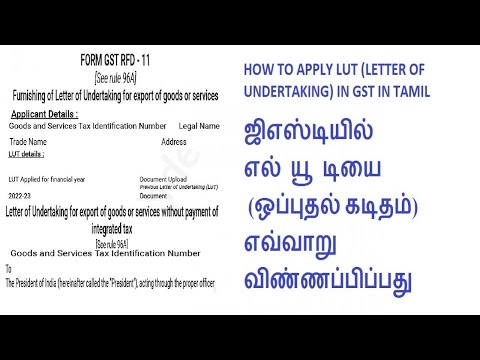

How to file LUT on GST portal for export of Goods or services | Export rules under GST

Показать описание

Any registered person availing the option to supply goods or services for export /SEZs without payment of integrated tax has to furnish, prior to export/SEZs supply, a Letter of Undertaking (LUT). Example of transactions for which LUT can be used are:

Zero rated supply to SEZ without payment of IGST.

Export of goods to a country outside India without payment of IGST.

Providing services to a client in a country outside India without payment of IGST.

________________________________________________

📞 Call at 9150010400 (only for courses)

_______________________________________________

👉🏻 Instant Tax updates are now available on What'sapp channel , Telegram Channel & our Website as below:

_________________________________________________________

____________________________________________________

____________________________________________________

Let's Connect on your Mobile :

___________________________________________________________

Family youtubechannels🔗

♥Like 👍 ♥ Share ♥Subscribe ♥ press the 🔔

_____________________________________________________________________

Disclaimer: our videos are for educational purposes only, we will not be responsible in any circumstances for any decision which you have taken after watching the content.

------------------------------------------------------------------------------------------------------------------

#caguruji #cagurujiclasses #gst #export #GSTLUT #gstfiling

Zero rated supply to SEZ without payment of IGST.

Export of goods to a country outside India without payment of IGST.

Providing services to a client in a country outside India without payment of IGST.

________________________________________________

📞 Call at 9150010400 (only for courses)

_______________________________________________

👉🏻 Instant Tax updates are now available on What'sapp channel , Telegram Channel & our Website as below:

_________________________________________________________

____________________________________________________

____________________________________________________

Let's Connect on your Mobile :

___________________________________________________________

Family youtubechannels🔗

♥Like 👍 ♥ Share ♥Subscribe ♥ press the 🔔

_____________________________________________________________________

Disclaimer: our videos are for educational purposes only, we will not be responsible in any circumstances for any decision which you have taken after watching the content.

------------------------------------------------------------------------------------------------------------------

#caguruji #cagurujiclasses #gst #export #GSTLUT #gstfiling

Комментарии

0:10:56

0:10:56

0:06:04

0:06:04

0:02:46

0:02:46

0:05:29

0:05:29

0:05:19

0:05:19

0:05:54

0:05:54

0:04:47

0:04:47

0:01:01

0:01:01

0:02:28

0:02:28

0:03:34

0:03:34

0:11:35

0:11:35

0:02:35

0:02:35

0:00:59

0:00:59

0:00:34

0:00:34

0:04:10

0:04:10

0:06:43

0:06:43

0:00:56

0:00:56

0:06:42

0:06:42

0:03:54

0:03:54

0:02:27

0:02:27

0:02:41

0:02:41

0:05:49

0:05:49

0:00:41

0:00:41

0:02:35

0:02:35