filmov

tv

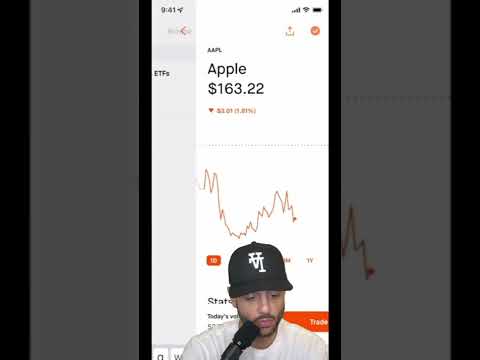

I Tried Stock Options Trading For a Week And Got RICH

Показать описание

I tried options trading for a week and got rich

Thanks for watching make sure to Like and Subscribe!

@Joorags on Instagram

Instagram - Joovier_

Snapchat - JosiahGS

I am NOT a CPA, Broker or any legal financial advisor. All the information I share is just for entertainment purposes so laugh a little :)

I don't own any of the songs in this video.

#Joovier #DayTrading #OptionsTrading

Thanks for watching make sure to Like and Subscribe!

@Joorags on Instagram

Instagram - Joovier_

Snapchat - JosiahGS

I am NOT a CPA, Broker or any legal financial advisor. All the information I share is just for entertainment purposes so laugh a little :)

I don't own any of the songs in this video.

#Joovier #DayTrading #OptionsTrading

I Tried Stock Options Trading For a Week

I Tried Stock Options Trading For a Week And Got RICH

I Traded STOCK OPTIONS as a Beginner - and it Actually Worked!

I Tried Day Trading for 8 Hours Straight

My Simple $5,000 / Day Stock Trading Strategy

MADE A MILLION OFF $460 ON TESLA ON ROBINHOOD || Wall Street Bets Options Trading

Results of $50k Stock Options Bet

How To Master Options Trading In 5 Minutes! - 2023 Edition

Morning Market Prep | Stock & Options Trading | 8-2-24

Trying to Turn $200 into $28000 Trading Options In 52 Weeks - WEEK 6

Turning $100 Into $1,000 Trading Stocks | Ep.2

Options Trading in 10 Minutes | How I Make $1,000/Day @ 19! | For Beginners!!

$100k Stock Options Trading Challenge | Ep. 2

Turning $100 Into $1,000 Trading Stocks | Ep.1

How I Make $1,000 A Day at 19 | Stock Market Options Trading For Beginners Made Easy!

How I Turned $1,500 to $60k in One Month!

Teaching My Friend How To Trade Options

Trading Stock Options to a Million EP.3

Options Trading in 10 Minutes | How to Make $1,000 a day | For Beginners Only

How I Learned To Trade In 2 Days

💰 How to trade options in 60 seconds

Unstoppable AF📈💯🔥💪🏼#futures #futurestrading #investing #trading #optionstrading #options...

50X Your Money With These Cheap Option Trading Strategies

Should You Be Trading Options? 🤔

Комментарии

0:10:05

0:10:05

0:14:05

0:14:05

0:24:16

0:24:16

0:03:36

0:03:36

0:09:16

0:09:16

0:00:29

0:00:29

0:00:53

0:00:53

0:08:01

0:08:01

0:33:51

0:33:51

0:04:52

0:04:52

0:00:30

0:00:30

0:13:17

0:13:17

0:10:49

0:10:49

0:00:26

0:00:26

0:38:36

0:38:36

0:10:01

0:10:01

0:20:39

0:20:39

0:12:38

0:12:38

0:10:31

0:10:31

0:05:24

0:05:24

0:00:52

0:00:52

0:00:37

0:00:37

0:16:30

0:16:30

0:00:23

0:00:23