filmov

tv

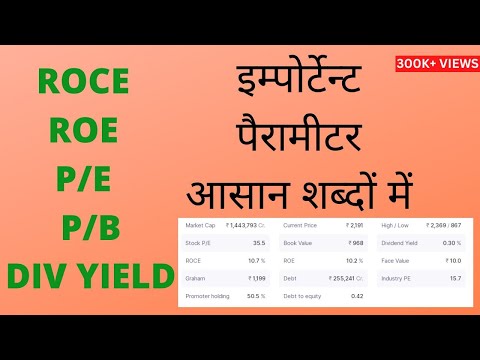

P/E, P/B Ratio & More - Financial Ratios for Easy Analysis of Companies! - STOCK MARKET A TO Z E19

Показать описание

In this video, we discuss how to study Key Financial Ratios of a company. We will be looking at the Annual Report of Dmart, and learning to easily analyse it using important financial ratios.

Profitability Ratios:

Profit & Profit Margin

EBITDA & EBITDA Margin

Return on Equity (RoE)

Return on Capital Employed (RoCE)

RoE vs RoCE

Return on Asset (RoA)

Earnings per Share(EPS)

Leverage Ratios:

Interest Coverage Ratio

Debt to Equity Ratio

Debt to Asset Ratio

Financial Leverage Ratio

This video continues on our Fundamental Analysis series and is the next step on how to analyse everything you need to know about companies before you invest in them.

Full Disclosure: These are affiliate links. Do use the links if you wish to support us, at no extra cost ❤️

#StockMarketAtoZ #SeekhegaMarketBanegaMoney #marketfeed

Stock Market A to Z is a complete video series to learn everything about the stock market, from basics to fundamental & technical analysis to futures & options to advanced trading strategies, all for FREE, presented by Sharique Samsudheen.

New videos will drop every Tuesday, Thursday and Saturday. Follow me on Instagram, LinkedIn and Twitter!

A humble request to all of you is to share this with your friends and family, and invite them to join this revolutionary journey!

Join Us on Telegram, search for - fundfolio by Sharique Samsudheen

Presented to you by #marketfeed from the house of #fundfolio

Комментарии

0:03:47

0:03:47

0:07:53

0:07:53

0:03:17

0:03:17

0:05:57

0:05:57

0:05:36

0:05:36

0:09:47

0:09:47

0:04:15

0:04:15

0:36:13

0:36:13

0:00:18

0:00:18

0:28:06

0:28:06

0:07:02

0:07:02

0:10:15

0:10:15

0:01:42

0:01:42

0:01:25

0:01:25

0:13:15

0:13:15

0:08:14

0:08:14

0:08:51

0:08:51

0:01:58

0:01:58

0:05:25

0:05:25

0:00:51

0:00:51

0:08:23

0:08:23

0:08:02

0:08:02

0:16:26

0:16:26

0:09:40

0:09:40