filmov

tv

Best Long Strategy with Hedge - ZEEHBS Options Trading Strategy

Показать описание

The ZEEHBS consists of bull back spread and hedged at 50%. The example is shown with the S&P 500 but can be used for any index (NASDAQ, Russell, DOW) or stock you are bullish on.

0 DTE Backtesting Software (50% Off First Year with Link):

SPX Automatic (Bot) Trading (Extended FREE trial of 30 days, no CC needed for signup) [TAT]:

Want to setup a tastytrade account? Use my referral code:

Resources to improve your trading:

Twitter: @decke192

Subreddit: r/IncomeOptionsTrading

See website above for full disclaimer. This video is for educational purposes only and is not a trading recommendation or advice. I am not a registered financial advisor.

0:00 ZEEHBS Intro

0:10 Risk Profile

0:40 ZEBRA

1:21 Why the ZEEHBS?

1:35 Underlyings to Use

2:10 The ZEEHBS Trade Setup

7:08 Valley of Death

8:03 Adjustments

14:09 ZEEHBS vs Straddle

Best Long Strategy with Hedge - ZEEHBS Options Trading Strategy

Master Hedging: A Pro Trader's Guide to Stress-Free, Consistent Returns

Nifty Monthly Strategy For Working People| Unlimited Profit | Zero Loss Strategy | No Loss Hedging |

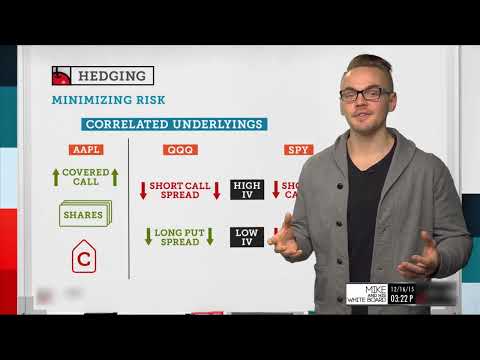

How to Hedge Your Positions | Options Trading Concepts

A Better Way to HEDGE Forex 2023

How To Use Options Like A PRO (Hedge Fund Strategy)

Very Simple Trading Strategy Hedge Funds Use To Be Profitable 🤯

How to Hedge Call or Put Options | Options Trading Strategies

How To Hedge Trading Forex | Live Hedging Strategy In 2025

Hedge fund strategies: Long short 1 | Finance & Capital Markets | Khan Academy

SIMPLEST WAY TO HEDGE IN FOREX

HOW TO HEDGE TRADING FOREX (2025) | Forex Hedging Strategy

How to Hedge trading Forex | Forex Hedging Strategy

Hedging in Option Trading? How to Hedge Your Positions in Stock Market?

Top 7 Forex Strategies used by Hedge Funds

Hedge Your Portfolio Like A Pro

Hedge trading explained! (GUARANTEED PROFITS?) │ FOREX TRADING

Best Hedging Strategy / Hedge position trading / today market strategy. #trading #stockmarket

How To Hedge your Portfolio like a PRO (Options Trading Strategy)

Top Hedge Fund Trading Strategies You Can Copy

Cross Hedge EA | 100% win Hedging Strategy | Win both side #ytshorts #forex #finance #reels #tiktok

A $16B hedge fund CIO gives an easy explanation of quantitative trading

Hedge trade | future with call option | #stockmarket #trading

The 95% Win Rate Trading Strategy Used By Banks & Hedge Funds 🔥

Комментарии

0:14:56

0:14:56

0:08:26

0:08:26

0:11:31

0:11:31

0:13:53

0:13:53

0:00:58

0:00:58

0:20:47

0:20:47

0:00:38

0:00:38

0:15:04

0:15:04

0:41:12

0:41:12

0:03:35

0:03:35

0:01:01

0:01:01

0:15:20

0:15:20

0:16:32

0:16:32

0:16:39

0:16:39

0:06:41

0:06:41

0:10:07

0:10:07

0:07:26

0:07:26

0:01:00

0:01:00

0:35:32

0:35:32

0:00:13

0:00:13

0:00:16

0:00:16

0:00:57

0:00:57

0:00:21

0:00:21

0:00:55

0:00:55