filmov

tv

Understanding the German Tax System: A Guide to Different Types of Taxes

Показать описание

Welcome to our comprehensive guide on the types of taxes in Germany! Whether you're a resident, an expat, or just curious about the German tax system, this video is for you.

In Germany, taxes play a crucial role in financing public services, infrastructure, and social welfare programs. Understanding the various types of taxes can help individuals and businesses navigate the complex German tax landscape more effectively.

In this video, we'll explore the main types of taxes in Germany:

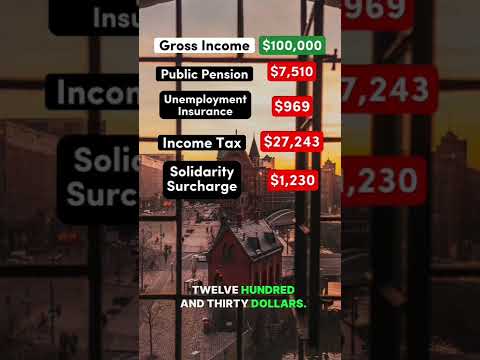

Income Tax: Germany operates a progressive income tax system, where tax rates increase as income levels rise. We'll delve into the different tax brackets and how income tax is calculated.

Value Added Tax (VAT): Known as "Umsatzsteuer" in German, VAT is a consumption tax levied on the purchase of goods and services. We'll discuss the standard VAT rate, reduced rates, and exemptions.

Corporate Tax: Businesses operating in Germany are subject to corporate income tax. We'll outline the corporate tax rate and deductions available to companies.

Capital Gains Tax: Profits from the sale of certain assets, such as stocks and real estate, are subject to capital gains tax. We'll cover the rules governing capital gains taxation and any exemptions or allowances.

Property Tax: Property owners in Germany are liable to pay property tax based on the assessed value of their real estate. We'll explain how property tax is calculated and its significance in the German tax system.

Inheritance and Gift Tax: Transfers of assets through inheritance or gifts may be subject to inheritance and gift tax. We'll explore the tax rates, exemptions, and allowances related to these transfers.

Solidarity Surcharge (Solidaritätszuschlag): Introduced to support the costs of reunification, the solidarity surcharge is an additional tax imposed on income and corporate tax. We'll discuss its purpose and applicability.

Understanding these different types of taxes is essential for individuals and businesses to fulfill their tax obligations in Germany. Whether you're filing taxes independently or seeking professional advice, knowledge about the German tax system empowers you to make informed financial decisions.

Stay tuned as we break down each tax type in detail, providing you with the insights you need to navigate the German tax landscape with confidence. Don't forget to like, share, and subscribe for more informative content on taxation and finance. Thanks for watching!

---------------

Connect with us:

---------------

Track

---------------

---------------

#globepravasi #livingingermany #germany

In Germany, taxes play a crucial role in financing public services, infrastructure, and social welfare programs. Understanding the various types of taxes can help individuals and businesses navigate the complex German tax landscape more effectively.

In this video, we'll explore the main types of taxes in Germany:

Income Tax: Germany operates a progressive income tax system, where tax rates increase as income levels rise. We'll delve into the different tax brackets and how income tax is calculated.

Value Added Tax (VAT): Known as "Umsatzsteuer" in German, VAT is a consumption tax levied on the purchase of goods and services. We'll discuss the standard VAT rate, reduced rates, and exemptions.

Corporate Tax: Businesses operating in Germany are subject to corporate income tax. We'll outline the corporate tax rate and deductions available to companies.

Capital Gains Tax: Profits from the sale of certain assets, such as stocks and real estate, are subject to capital gains tax. We'll cover the rules governing capital gains taxation and any exemptions or allowances.

Property Tax: Property owners in Germany are liable to pay property tax based on the assessed value of their real estate. We'll explain how property tax is calculated and its significance in the German tax system.

Inheritance and Gift Tax: Transfers of assets through inheritance or gifts may be subject to inheritance and gift tax. We'll explore the tax rates, exemptions, and allowances related to these transfers.

Solidarity Surcharge (Solidaritätszuschlag): Introduced to support the costs of reunification, the solidarity surcharge is an additional tax imposed on income and corporate tax. We'll discuss its purpose and applicability.

Understanding these different types of taxes is essential for individuals and businesses to fulfill their tax obligations in Germany. Whether you're filing taxes independently or seeking professional advice, knowledge about the German tax system empowers you to make informed financial decisions.

Stay tuned as we break down each tax type in detail, providing you with the insights you need to navigate the German tax landscape with confidence. Don't forget to like, share, and subscribe for more informative content on taxation and finance. Thanks for watching!

---------------

Connect with us:

---------------

Track

---------------

---------------

#globepravasi #livingingermany #germany

Комментарии

0:12:15

0:12:15

0:03:32

0:03:32

0:07:33

0:07:33

0:02:52

0:02:52

0:00:48

0:00:48

0:14:58

0:14:58

0:08:57

0:08:57

0:21:05

0:21:05

0:00:29

0:00:29

0:00:59

0:00:59

0:02:40

0:02:40

0:09:48

0:09:48

0:04:11

0:04:11

0:07:03

0:07:03

0:00:15

0:00:15

0:06:35

0:06:35

0:00:15

0:00:15

0:00:38

0:00:38

0:11:17

0:11:17

0:05:59

0:05:59

0:02:32

0:02:32

1:04:59

1:04:59

0:06:33

0:06:33

0:00:30

0:00:30