filmov

tv

Taxes in Germany explained (explainity® explainer video)

Показать описание

If you live in Germany and earn money, in most cases you have to pay Taxes. But why does the State delve into our pockets like this? And what does we get out of it? explainity tackles these questions and gives some answers in this short clip.

-------

This explainer video was produced by explainity GmbH

-------

This explainer video was produced by explainity GmbH

Taxes in Germany explained (explainity® explainer video)

property tax explained (explainity® explainer video)

6 Tax classes In Germany Explained in English [Easy 2021 Guide]

Taxes in Germany Explained | Income Tax, Tax Classes, Church Tax, Solidarity Tax

The 6 Different Tax Classes in Germany: Tax Class System in Germany Explained 😲

Steuern in Deutschland einfach erklärt (explainity® Erklärvideo)

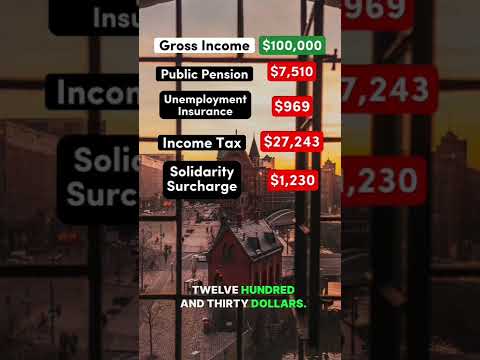

How Much Taxes Do You Pay In Germany?

Cum-ex deals explained (explainity® explainer video)

HOW ARE TAXES IN GERMANY? || GERMAN TAXES EXPLAINED || The Phoebe Way

How Much Taxes You Really Pay In Germany | PerFinEx Taxes

Germany HAD the Oddest Tax Rate and it worked

What is the annual house tax in Germany?

Tax Rate & Tax Free Income in Germany Explained: How Much Taxes Are You Paying As Of Your Income...

How Do You Reduce Taxes In Germany? | PerFinEx Taxes

German election system / Bundestagswahl easily explained (explainity® explainer video)

Living on $100k After Taxes in Germany #germany #conservative #liberal #taxes #salary

German tax office people

Taxation in Germany: corporate tax, trade tax, VAT, payroll and other German taxes

Invest & Save Taxes In Germany? Here’s How

What is the 183 day rule for German tax?

German VAT for Dummies

What Taxes you have to pay in Germany?

Tax Class With Spouse NOT In Germany

Income Taxes working in Germany - Salary Payslip analysis (2020)

Комментарии

0:03:32

0:03:32

0:02:43

0:02:43

0:06:30

0:06:30

0:10:14

0:10:14

0:06:35

0:06:35

0:03:21

0:03:21

0:00:52

0:00:52

0:04:15

0:04:15

0:07:02

0:07:02

0:06:23

0:06:23

0:00:50

0:00:50

0:00:40

0:00:40

0:02:57

0:02:57

0:06:34

0:06:34

0:05:15

0:05:15

0:00:38

0:00:38

0:00:07

0:00:07

0:08:57

0:08:57

0:00:54

0:00:54

0:00:39

0:00:39

0:03:10

0:03:10

0:07:05

0:07:05

0:00:59

0:00:59

0:10:02

0:10:02