filmov

tv

Modified Internal Rate of Return | MIRR | FIN-Ed

Показать описание

#fin-ed

Modified Internal Rate of Return | MIRR | FIN-Ed

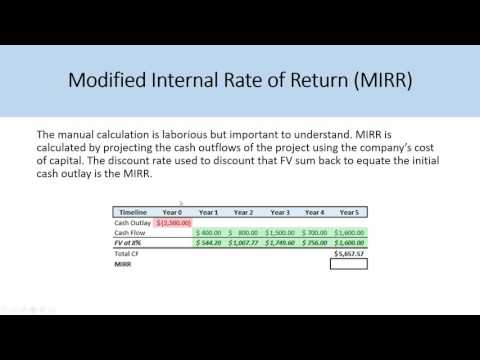

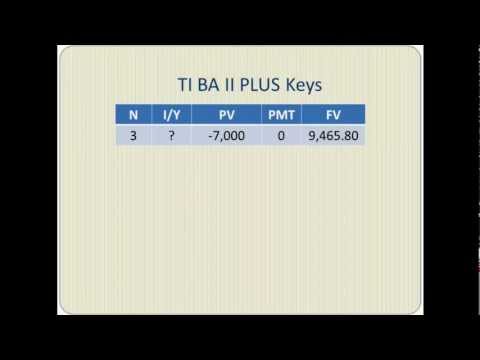

This video is about how to calculate the modified internal rate of return or MIRR using a Texas BA II Plus financial calculator. MIRR is the discount rate at which the present value of a project’s costs is equal to the present value of its terminal value. Terminal value is defined as the sum of future values of all cash inflows. Some projects may have non-normal cash flows and, thus, may have multiple IRRs. In such a situation, project selection might be erroneous or misleading. In order to avoid multiple IRR problems, it is always better to use the MIRR technique while accepting or rejecting a project.

Example:

Your division is considering two projects with the following cash flows (in millions). If WACC is 10%, What are the projects’ MIRR and which project will you accept?

Source: Fundamentals of Financial Management (Concise Edition) Brigham and Houston

Chapter 11: The Basics of Capital Budgeting

Problem: 11-6

========Recommended Videos=============

========================================

Thanks for watching...!!!

Modified Internal Rate of Return | MIRR | FIN-Ed

This video is about how to calculate the modified internal rate of return or MIRR using a Texas BA II Plus financial calculator. MIRR is the discount rate at which the present value of a project’s costs is equal to the present value of its terminal value. Terminal value is defined as the sum of future values of all cash inflows. Some projects may have non-normal cash flows and, thus, may have multiple IRRs. In such a situation, project selection might be erroneous or misleading. In order to avoid multiple IRR problems, it is always better to use the MIRR technique while accepting or rejecting a project.

Example:

Your division is considering two projects with the following cash flows (in millions). If WACC is 10%, What are the projects’ MIRR and which project will you accept?

Source: Fundamentals of Financial Management (Concise Edition) Brigham and Houston

Chapter 11: The Basics of Capital Budgeting

Problem: 11-6

========Recommended Videos=============

========================================

Thanks for watching...!!!

Modified Internal Rate of Return | MIRR | FIN-Ed

Modified Internal Rate of Return (MIRR) - Basics, Formula, Calculations in Excel (Step by Step)

What is Modified Internal Rate of Return and how to Calculate it

Modified Internal Rate of Return (MIRR)

Modified IRR - Example 1

Modified internal rate of return

FINANCIAL MANAGEMENT DECEMBER 2023 -MODIFIED INTERNAL RATE OF RETURN(MIRR) KASNEB

IRR vs MIRR - The Problem With IRR Explained

CAPITAL INVESTMENT DECISIONS

CIMA P2 Modified Internal Rate of Return

Modified Internal Rate of Return (MIRR) And The Multiple IRR Problem

Modified Internal Rate of Return | IRR vs MIRR | CMA USA | ACCA P4 | Advanced Financial Management

MIRR|Modified IRR Technique of Investment Appraisal in Capital Budgeting|

IRR & MIRR Calculation - Modified Internal Rate of Return: INVESTMENT APPRAISAL QUESTIONS (ICAN ...

Capital Budgeting: Modified Internal Rate of Return (MIRR) on the BAII Plus

Internal Rate of Return (IRR) and the Modified Internal Rate of Return (MIRR) Exercises

Modified Internal Rate of Return (MIRR of even cash flows)

Calculate Modified Internal Rate of Return

Modified Internal Rate of Return MIRR | Capital Budgeting | CAP CLASSES

Modified Internal Rate of Return (MIRR)

CIMA P2 - Modified Internal Rate of Return (MIRR) | Advanced Management Accounting | Complete Guide

Modified IRR - Example 3

Modified Internal Rate of Return (MIRR)

Capital Budgeting (Part 9) - Modified IRR & Multiple IRR - CMA/CA Inter - FM | CMA Final (SFM)

Комментарии

0:06:02

0:06:02

0:14:00

0:14:00

0:05:19

0:05:19

0:07:58

0:07:58

0:07:02

0:07:02

0:01:32

0:01:32

0:47:29

0:47:29

0:18:11

0:18:11

2:25:11

2:25:11

0:27:16

0:27:16

0:11:37

0:11:37

0:20:41

0:20:41

0:11:41

0:11:41

0:19:12

0:19:12

0:07:17

0:07:17

0:14:48

0:14:48

0:04:55

0:04:55

0:09:31

0:09:31

0:15:19

0:15:19

0:03:47

0:03:47

0:09:20

0:09:20

0:10:32

0:10:32

0:09:17

0:09:17

0:33:40

0:33:40