filmov

tv

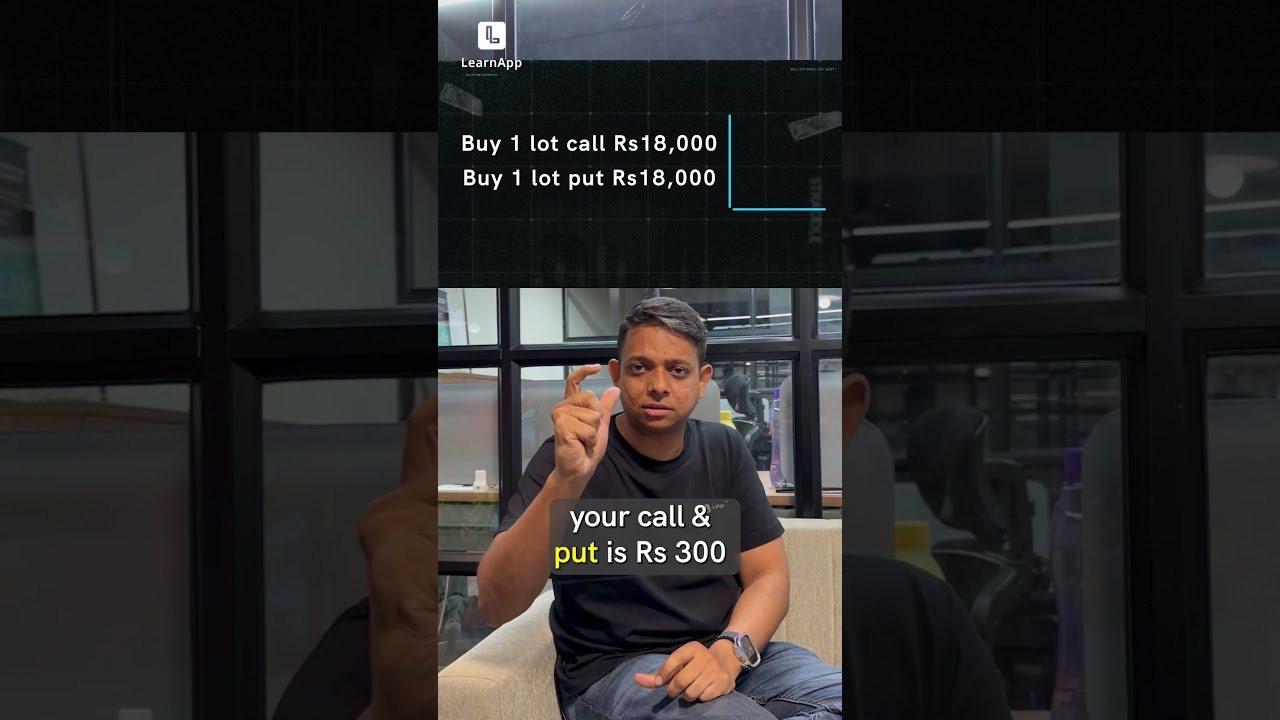

Learn THIS Easy Strategy to Make Money in Volatile Markets

Показать описание

Join LearnApp Prime, a 2-day free experience that covers everything around systematic trading, from basics to building a backtested strategy. Not everyone gets a seat at Prime. Apply here👇

💡 Binary Options Trading Strategy - Learn Pocket Option Secrets

My Incredible Easy Scalping Strategy To Make $500/Day (Back Tested Results)

Learn THIS Easy Strategy to Make Money in Volatile Markets

Easy to learn WYCKOFF STRATEGY 📈

📈 Binary Options Made Easy: Strategies, Signals, and Trading Tutorials

🟠 Binary Trading Strategy - Full Course For Beginners To Earn $5,000 Easily

Easy Day Trading Strategy ANYONE Can Learn! ✅

My Stupid Easy 2 Minute Scalping Strategy To Make $15K/Week

Real Time investment strategies and easy side hustles

Learn This Easy Yet POWERFUL Day Trading/Scalping Strategy | Cryptocurrency Tutorial

Original Thinking Is Easy, Actually (5 Strategies For Smart People)

My EASY $1000 A Day Trading Strategy 2025 (How To Tutorial)

Trend line strategy (EASY)

My Incredibly Easy 1 Minute Scalping Strategy To Make $10,000/Month (Backtested Results)

💪 Pocket Option Strategy So Easy a Beginner Can Make Money!

EASY 5 MINUTE CRYPTO SCALPING STRATEGY

Make $3K Every DAY Trading GOLD (Easy Strategy)

My Incredibly Easy 1 Minute Scalping Strategy (Full Course)

Easy LinkedIn Strategy! #podcast #linkedinstrategy #linkedinmarketing

How to Trade the Double Bottom Chart Pattern - Learn This Easy Strategy Today! | Beginner Tutorial

Effortless Study Strategies for Faster and Easier Learning

I Use This Strategy To Find EASY Meme Coin 2X's EVERYDAY

My strategy is easy ✌🏻

This simple blackjack strategy is EASY MONEY #Blackjack #Casino #Gambling #Betting

Комментарии

0:11:12

0:11:12

0:12:05

0:12:05

0:00:51

0:00:51

0:00:24

0:00:24

0:13:06

0:13:06

0:10:45

0:10:45

0:08:41

0:08:41

0:16:51

0:16:51

0:00:37

0:00:37

0:15:22

0:15:22

0:29:59

0:29:59

0:10:47

0:10:47

0:00:35

0:00:35

0:13:20

0:13:20

0:12:39

0:12:39

0:00:48

0:00:48

0:09:02

0:09:02

0:24:05

0:24:05

0:00:55

0:00:55

0:05:22

0:05:22

0:00:53

0:00:53

0:10:09

0:10:09

0:00:23

0:00:23

0:00:20

0:00:20