filmov

tv

Tax cuts will boost the economy in 2018: Art Laffer

Показать описание

Economist Art Laffer on how the GOP tax plan will help promote economic growth in 2018.

Do tax cuts stimulate the economy? - Jonathan Smith

Pelosi: Payroll Tax Cut Deal Will 'Boost' Economy

Greece’s new gov't says tax cuts will boost jobs and investment

Trump doubles down on promise to pass historic tax cuts

Tax cuts by Liz Truss will give 'economic boost' - Education Secretary

Coronavirus: Federal Budget to accelerate income tax cuts for economy boost | 9 News Australia

Here's how tax cuts affect the economy

How tax breaks help the rich

Frydenberg on whether tax cuts will be spent or saved, and help for the over 50s | News Breakfast

President Trump's payroll tax cut: What to expect on your paystub and will it help jolt the eco...

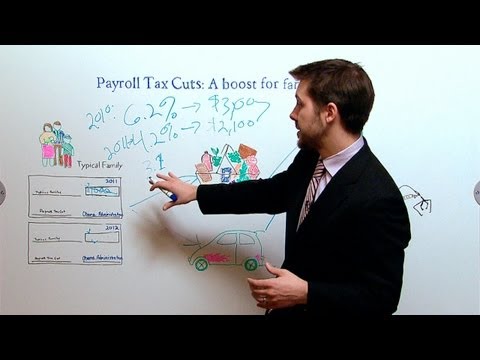

White House White Board: Payroll Tax Cuts

Trump's possible tax cuts would benefit most Americans: Grover Norquist

Trump's tax cuts have stimulated our economy: RNC chair

Tax Cuts Already Raising Wages?

Top earners £10k better off following tax cuts

Trump wants a pass-through tax cut. It was a disaster in Kansas.

BREAKING: Federal Reserve Cancels 2025 Interest Rate Cuts Because of Rising Inflation (4 Cuts to 2)

How tax cuts could drive the S&P higher in 2025

A Bold New Idea to Boost Wages | Robert Reich

Delaying the Trump tax cuts is 'dangerous,' expert warns

Trump administration says it is not considering a payroll tax cut

Who will reap the wealth of the GOP corporate tax cut?

Gary Cohn On Tax Cuts: CEOs Are “Most Excited Group” | All In | MSNBC

Will a Lower Corporate Income Tax Rate Boost Economic Growth?

Комментарии

0:04:39

0:04:39

0:02:00

0:02:00

0:02:21

0:02:21

0:05:40

0:05:40

0:10:50

0:10:50

0:02:58

0:02:58

0:01:52

0:01:52

0:08:47

0:08:47

0:05:40

0:05:40

0:05:32

0:05:32

0:05:51

0:05:51

0:07:51

0:07:51

0:02:00

0:02:00

0:10:04

0:10:04

0:02:09

0:02:09

0:04:08

0:04:08

0:05:00

0:05:00

0:07:59

0:07:59

0:04:21

0:04:21

0:10:55

0:10:55

0:01:31

0:01:31

0:04:43

0:04:43

0:03:56

0:03:56

0:11:54

0:11:54