filmov

tv

The Shocking Reasons Why People Stay In Debt (Don't Do This)

Показать описание

The Shocking Reasons Why People Stay In Debt (Don't Do This)

Debt is a huge part of modern life, impacting people from all walks of life, no matter how much money they make, their education level, or their social status. We often think people end up in debt because of unavoidable financial mistakes or tough economic times. However, the reasons people stay stuck in debt are much more complicated and, honestly, pretty surprising. Let’s take a look at the real reasons behind chronic debt–spoiler alert, it’s not good.

Debt is a huge part of modern life, impacting people from all walks of life, no matter how much money they make, their education level, or their social status. We often think people end up in debt because of unavoidable financial mistakes or tough economic times. However, the reasons people stay stuck in debt are much more complicated and, honestly, pretty surprising. Let’s take a look at the real reasons behind chronic debt–spoiler alert, it’s not good.

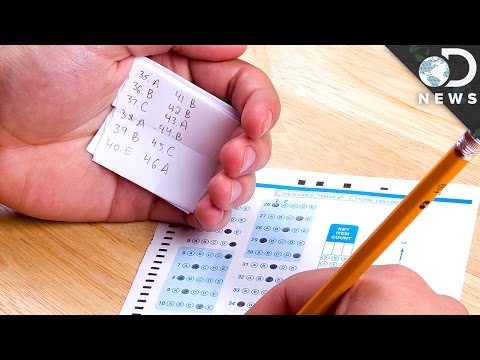

The Shocking Reason Why People Cheat On Tests

SHOCKING TRUTH about Karma: Why Bad People Get Their Way | What Happened to Doing Good?

The Shocking Effects of Caffeine On Mental Health

The Shocking Reason 10 out of 10 People Get Color Analysis Wrong!

The Shocking Truths About Why People Won't Move to West Virginia

The Shocking AI Reveals That Stunned CES 2025 (DAY 4)

The Background of the Shocking Youth Message - Paul Washer

The shocking transformation of the UK household diet since 1980 😲🍔 BBC

The shocking reality of health inequality - BBC

The SHOCKING Reasons The Japanese Live SO LONG! | Dr. Steven Gundry

The Shocking Truths About Why People Won't Move to Louisiana.

The SHOCKING Reason Black People Are Moving to Asia | Documentary [2019]

The Shocking Eating Tradition of Japan!

The shocking amount of sugar hiding in your food - BBC

The Shocking Reality of the Eucharist

The Shocking Reason Diapers Are Selling Like Crazy in China

Shocking Story of Personality Splitting to Sabotage the German Fleet

The Shocking Reason Many Believers Will Miss the Rapture

SHOCKING Sermon | Paul Washer | Inspirational & Motivational Video

The Shocking Danger my Brother Faced at Night in CHINA!

The Shocking Reason Why She was Erased From History | Step Empress Nara

Banna People's SHOCKING Reason for Walking on Stilts Revealed! #facts #culture #viralvideo #sho...

Most Shocking TRANSFERS Of 2025😱😳

The shocking truth about why 96% of people struggle financially! 🤯💼

Комментарии

0:02:44

0:02:44

0:04:43

0:04:43

0:05:52

0:05:52

0:27:28

0:27:28

0:11:57

0:11:57

0:10:48

0:10:48

0:11:45

0:11:45

0:03:56

0:03:56

0:03:28

0:03:28

0:12:29

0:12:29

0:10:43

0:10:43

0:40:01

0:40:01

0:00:20

0:00:20

0:03:32

0:03:32

0:08:26

0:08:26

0:00:38

0:00:38

0:00:58

0:00:58

1:03:10

1:03:10

0:17:21

0:17:21

0:15:13

0:15:13

0:14:46

0:14:46

0:00:46

0:00:46

0:00:47

0:00:47

0:00:52

0:00:52