filmov

tv

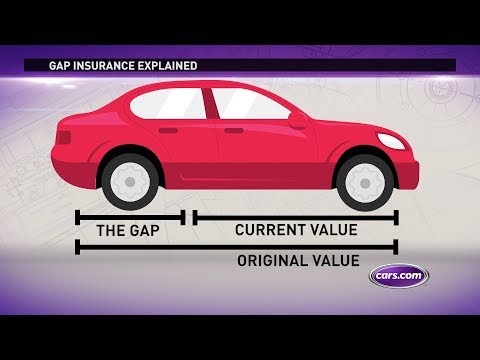

What is GAP Insurance? - Cost, Coverage, and Value

Показать описание

In this episode of Proctor Car Tips, Will explains Vehicle Guaranteed Asset Protection (GAP), a type of vehicle insurance you can add on to your protection warranty when buying a car. He explains GAP, why it is important, when to consider GAP insurance, and if it is worth the cost. This is a helpful guide to watch before adding GAP insurance to your next vehicle purchase!

Learn more at,

Guaranteed Asset Protection (GAP) - Vehicle Protection Warranty

Learn more about common car issues, new car features, car parts, car financing, or new cars on the Proctor Car Tips Channel. These helpful car tip videos will help you learn more about car parts, how to fix common car issues, purchasing a new vehicle, trading in your old vehicle, understanding new car features, or virtually road testing the newest cars on the market.

Proctor Car Tips

The Proctor Car tips channel is owned and operating by The Proctor Dealerships which include:

Learn more at,

Guaranteed Asset Protection (GAP) - Vehicle Protection Warranty

Learn more about common car issues, new car features, car parts, car financing, or new cars on the Proctor Car Tips Channel. These helpful car tip videos will help you learn more about car parts, how to fix common car issues, purchasing a new vehicle, trading in your old vehicle, understanding new car features, or virtually road testing the newest cars on the market.

Proctor Car Tips

The Proctor Car tips channel is owned and operating by The Proctor Dealerships which include:

What is Gap Insurance?

What is GAP insurance and should you buy it?

How Does Gap Insurance Work?

GAP Insurance 101

GAP Insurance | Buy from dealer or Insurance company?

What is GAP Insurance? | GAP Insurance Explained

Understanding Auto Insurance: What’s Gap Insurance?

What is Gap Insurance?

Medicare Part D (Drugs) Changes are coming in 2025. Medicare Prescription Drug costs are going down!

What Is GAP Insurance?

CAR GAP INSURANCE in 2024: (Brief & Brilliant) CAR DEALER FINANCE The Homework Guy Kevin Hunter

What is GAP Insurance? - Cost, Coverage, and Value

What Is GAP Insurance? GAP Insurance Explained

What is GAP Insurance?

GAP... Should you get it? #carbuying #finance #autofinancesense

Gap Insurance EXPLAINED

How Does Gap Insurance Work? | Progressive Answers

What is GAP Insurance? RTI Explained

GAP INSURANCE, How it works / How to get money back!

What Does Gap Insurance Cover?

Explaining gap insurance

What is GAP Insurance? RTV Explained

YOU DON'T NEED GAP INSURANCE ON YOUR CAR: Find out WHY - Auto Expert: The Homework Guy, Kevin H...

What is Gap Insurance?

Комментарии

0:01:45

0:01:45

0:03:56

0:03:56

0:04:44

0:04:44

0:04:51

0:04:51

0:06:20

0:06:20

0:13:59

0:13:59

0:01:34

0:01:34

0:00:58

0:00:58

0:04:21

0:04:21

0:01:41

0:01:41

0:05:30

0:05:30

0:01:59

0:01:59

0:00:52

0:00:52

0:01:10

0:01:10

0:17:38

0:17:38

0:13:52

0:13:52

0:01:45

0:01:45

0:01:07

0:01:07

0:05:34

0:05:34

0:01:37

0:01:37

0:02:01

0:02:01

0:00:55

0:00:55

0:11:25

0:11:25

0:02:00

0:02:00