filmov

tv

Startup Advisor Equity? - Pebble Watch Founder Eric Migicovsky

Показать описание

Pebble Watch founder and Y Combinator partner Eric Migicovsky on how he found startup advisors, how his advisors helped Pebble, and how he compensated his advisors with equity.

Y Combinator invests a small amount of money ($150k) in a large number of startups (recently 200), twice a year.

Y Combinator invests a small amount of money ($150k) in a large number of startups (recently 200), twice a year.

Startup Advisor Equity? - Pebble Watch Founder Eric Migicovsky

How much equity should I give my startup advisor?

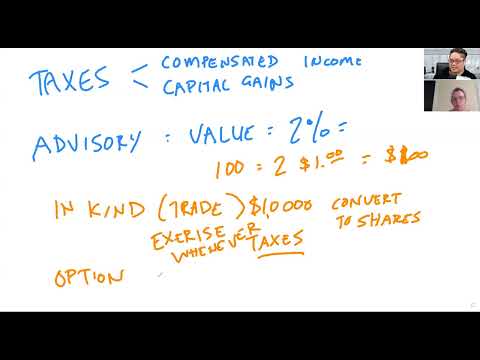

How to Compensate a Startup Advisor with Equity

How much equity to give a Startup Advisor?

How much to pay startup advisors - AskAVC #25

'Choose Your Own Adventure Investing' with Justin Whitehead of Pebble Finance

How much equity do I need for advisory board?

How are you thinking about advisors to your startup and the role they serve

Equity Interest for Startup Advisors

Why your advisors should be investors in your Startup

From big law to startup advisor and venture capitalist, I couldn’t be happier 💖 #startups

Advisory Shares: A Guide for Investors

Advisory shares?

How to find the right startup advisor #startupadvice #finance #mentoring #business #startupadvisor

How much equity should you give an advisor |Startup | Sarthak Ahuja

Time is a startup advisor’s capital. Pitch them that your startup is worth their time!

Does your startup need a board of advisors?

Advisory Shares ? #sharktank #enterpreneur #startup

Decoding Advisory Shares: A Comprehensive Guide to How They Work

Creating A Startup Board Of Advisors Is A Waste

What are advisory shares on Shark Tank?

Startup advisor insights #startup #siliconvalley #fyp #entrepreneur #business

How I Lost My Startup Equity

Navigating Startup Shares: Advisory vs Equity

Комментарии

0:03:41

0:03:41

0:01:53

0:01:53

0:18:09

0:18:09

0:00:55

0:00:55

0:07:15

0:07:15

0:11:42

0:11:42

0:04:32

0:04:32

0:00:52

0:00:52

0:05:29

0:05:29

0:02:29

0:02:29

0:00:08

0:00:08

0:05:01

0:05:01

0:01:41

0:01:41

0:00:58

0:00:58

0:00:39

0:00:39

0:00:56

0:00:56

0:11:38

0:11:38

0:00:16

0:00:16

0:05:43

0:05:43

0:08:24

0:08:24

0:01:01

0:01:01

0:00:46

0:00:46

0:00:28

0:00:28

0:03:41

0:03:41