filmov

tv

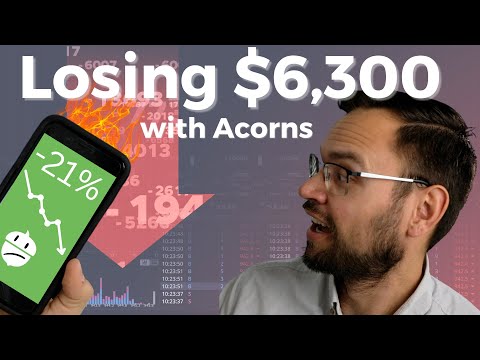

Leaving Acorns and Why You Should Too

Показать описание

It's been a long time coming, but it's finally time to leave the Acorns platform in the past. Acorns is costing you more than you think and I explain it all here.

Investing Links | Free Stocks + Cash

Saving Money Links

Cryptocurrency

Credit Card Links

Socials

Disclaimers:

I’m not a financial advisor. The information contained in this video is for entertainment purposes only. Before investing, please consult a licensed professional. Any stock purchases I show on video should not be considered “investment recommendations”. I shall not be held liable for any losses you may incur for investing and trading in the stock market in attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely.

Thank you for all your support as always! Love y’all!

Investing Links | Free Stocks + Cash

Saving Money Links

Cryptocurrency

Credit Card Links

Socials

Disclaimers:

I’m not a financial advisor. The information contained in this video is for entertainment purposes only. Before investing, please consult a licensed professional. Any stock purchases I show on video should not be considered “investment recommendations”. I shall not be held liable for any losses you may incur for investing and trading in the stock market in attempt to mirror what I do. Unless investments are FDIC insured, they may decline in value and/or disappear entirely.

Thank you for all your support as always! Love y’all!

Leaving Acorns and Why You Should Too

I Invested $10 Per Day Into Acorns For A Year... Here's The Results

What you MUST know about Acorns Investing

Why I'm Leaving the Acorns Investing App? *My Experience*

Why I'm Leaving Acorns...

Should I Use The Acorns App For Investing?

Acorns Invest massive mistake - That's not a LOSS! #shorts #acorns #investing

Acorns Returns After 20 Months: Why I Lost Money

Fall Garland Trends 2024: Creative DIY Ideas for Stunning Autumn Décor.

Acorns Review: The Good And The Bad

How to eat acorns - hot leaching method by boiling the tannic acid out

What's up with the nuts?! North Texas sees 'mast' year leaving acorns all over

4 Years with Acorns: A Comprehensive Review

Can you stop a tree from dropping acorns?

How To Withdraw Your Money From Acorns

OAK TREE From ACORN Time Lapse

How to draw acorns. Oak Leaves / Art for Kids

Corn starch from acorns?

How to get money out of Acorns Invest account #investing #brendanevan #shorts

Exterminator Finds Thousands of Acorns Behind Wall of House

How to Eat Acorns - Hot Leaching Method

😳 These Acorns Grew THROUGH the COMPOST #gardening

How to plant #acorns and get some baby oak seedlings #gardening #gardeningtips #trees #growth #roots

You should know these #foraging #acorns #oak

Комментарии

0:11:27

0:11:27

0:09:30

0:09:30

0:15:31

0:15:31

0:05:32

0:05:32

0:10:34

0:10:34

0:06:32

0:06:32

0:00:38

0:00:38

0:12:09

0:12:09

0:00:23

0:00:23

0:27:14

0:27:14

0:01:00

0:01:00

0:03:17

0:03:17

0:38:24

0:38:24

0:01:05

0:01:05

0:01:41

0:01:41

0:02:16

0:02:16

0:01:05

0:01:05

0:01:00

0:01:00

0:00:46

0:00:46

0:01:32

0:01:32

0:02:11

0:02:11

0:00:36

0:00:36

0:00:44

0:00:44

0:01:00

0:01:00