filmov

tv

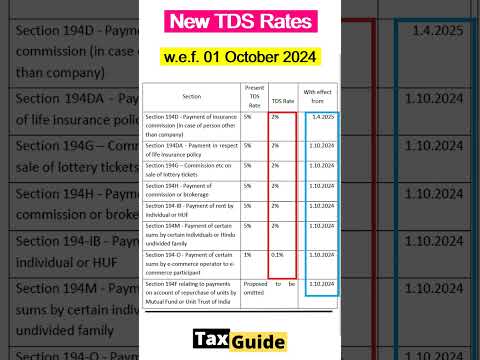

Tax Update from 1 Oct 2024

Показать описание

Tax Update from 1 Oct 2024

👨🏻🎓FinTaxPro Practical Courses-

📞For Course queries call us at 7827521794

📞For GST Filing, ITR Filing, Trademark Filing, Trademark Reply, Company Incorporation, ROC Compliance, and other related services call us at 7048930220 or 9718097735

⚠ Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

© Copyright Disclosure - As per Sec 52 of The Copyright Act,1957 Fintaxpro Advisory LLP shared this video with a clear objective to educate the public at large and thus constitute the fair dealing with content for the purpose of reporting of current events and current affairs, including the reporting of a lecture delivered in public.

⚠Data Disclosure Policy – FinTaxPro ensures that any client information, such as GSTIN, PAN, and Turnover, displayed in educational videos is shared only with the owner's consent and used strictly for educational purposes. All necessary permissions are obtained before publishing, and robust data protection measures are in place to safeguard the information.

©️Fintaxpro Advisory LLP

👨🏻🎓FinTaxPro Practical Courses-

📞For Course queries call us at 7827521794

📞For GST Filing, ITR Filing, Trademark Filing, Trademark Reply, Company Incorporation, ROC Compliance, and other related services call us at 7048930220 or 9718097735

⚠ Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

© Copyright Disclosure - As per Sec 52 of The Copyright Act,1957 Fintaxpro Advisory LLP shared this video with a clear objective to educate the public at large and thus constitute the fair dealing with content for the purpose of reporting of current events and current affairs, including the reporting of a lecture delivered in public.

⚠Data Disclosure Policy – FinTaxPro ensures that any client information, such as GSTIN, PAN, and Turnover, displayed in educational videos is shared only with the owner's consent and used strictly for educational purposes. All necessary permissions are obtained before publishing, and robust data protection measures are in place to safeguard the information.

©️Fintaxpro Advisory LLP

Комментарии

0:08:50

0:08:50

0:14:38

0:14:38

0:14:18

0:14:18

0:17:03

0:17:03

0:01:01

0:01:01

0:08:08

0:08:08

2:13:40

2:13:40

0:13:11

0:13:11

0:21:55

0:21:55

0:07:05

0:07:05

0:00:36

0:00:36

0:03:31

0:03:31

0:07:23

0:07:23

0:09:43

0:09:43

0:02:23

0:02:23

0:07:26

0:07:26

0:10:29

0:10:29

0:12:14

0:12:14

0:10:44

0:10:44

0:04:37

0:04:37

0:00:52

0:00:52

0:13:33

0:13:33

0:01:00

0:01:00

0:11:18

0:11:18