filmov

tv

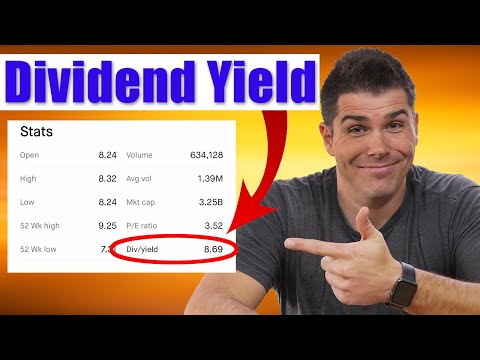

Dividend Yield Vs Yield On Cost | Measure Your Performance

Показать описание

Dividend Growth investing is very popular amongst investors who want to make passive income. There is a performance measurement called Yield on Cost that will help you determine your success as a dividend investor, which I cover here in detail. I also provide a portfolio performance update in this video.

SUBSCRIBE So You Don't Miss Any Content!

My latest video on Bank Stocks:

Get a free stock from ROBINHOOD when you sign up with this link.

The power of Dividends! I take a dive into a performance measurement that you can use to determine how well your cost basis Yield is compared to the stock markets. This measurement is called Yield on Cost and you compare it to your portfolios market dividend yield. Now this is one of many metrics to evaluate how healthy your portfolio is, but I consider this one essential.

I provide an example I created to explain how this comparison works, what it does, and how you can utilize it in your our investment portfolio. The goal is to grow my passive income to the point I can retire and rely on the dividends I receive to pay bills and other expenses. Evaluating the Yield on cost vs the market yield of my portfolio over time will help me look at the level of success of my stocks and make any necessary adjustments to ensure my passive Income is healthy and growing.

One essential thing to growing your Yield On Cost is to invest in Quality company's. You want stable companies with healthy balance sheets with a low Liability to Asset ratio. You want to choose company's that are not highly leveraged creating confidence that during down times they will not go bankrupt or go out of business. A quality company has a low payout ratio while increasing their dividends year after year. You want a company with a good management team that focuses on innovation and good investments that bring high returns. A quality company also has a large MOAT, competitive advantage, and a possibly other things like a sticky subscription based service that brings in dependable revenue. All this helps to ensure your dividend yield on cost remains above the markets and that it grows steadily.

So do you track your portfolios yield on cost vs the market yield of your portfolio? Will you start after watching this video?

Thank you for watching and have a great day!

Questions or Inquires, Email me:

*This Video is not meant to be professional advice, but is rather for entertainment purposes only. Take all of my videos as my own opinion, and at your own risk. This Video is accurate as of the posting date but may not be accurate in the future. Links above include affiliate commission or referrals.

SUBSCRIBE So You Don't Miss Any Content!

My latest video on Bank Stocks:

Get a free stock from ROBINHOOD when you sign up with this link.

The power of Dividends! I take a dive into a performance measurement that you can use to determine how well your cost basis Yield is compared to the stock markets. This measurement is called Yield on Cost and you compare it to your portfolios market dividend yield. Now this is one of many metrics to evaluate how healthy your portfolio is, but I consider this one essential.

I provide an example I created to explain how this comparison works, what it does, and how you can utilize it in your our investment portfolio. The goal is to grow my passive income to the point I can retire and rely on the dividends I receive to pay bills and other expenses. Evaluating the Yield on cost vs the market yield of my portfolio over time will help me look at the level of success of my stocks and make any necessary adjustments to ensure my passive Income is healthy and growing.

One essential thing to growing your Yield On Cost is to invest in Quality company's. You want stable companies with healthy balance sheets with a low Liability to Asset ratio. You want to choose company's that are not highly leveraged creating confidence that during down times they will not go bankrupt or go out of business. A quality company has a low payout ratio while increasing their dividends year after year. You want a company with a good management team that focuses on innovation and good investments that bring high returns. A quality company also has a large MOAT, competitive advantage, and a possibly other things like a sticky subscription based service that brings in dependable revenue. All this helps to ensure your dividend yield on cost remains above the markets and that it grows steadily.

So do you track your portfolios yield on cost vs the market yield of your portfolio? Will you start after watching this video?

Thank you for watching and have a great day!

Questions or Inquires, Email me:

*This Video is not meant to be professional advice, but is rather for entertainment purposes only. Take all of my videos as my own opinion, and at your own risk. This Video is accurate as of the posting date but may not be accurate in the future. Links above include affiliate commission or referrals.

Комментарии

0:04:42

0:04:42

0:10:19

0:10:19

0:18:58

0:18:58

0:11:34

0:11:34

0:01:23

0:01:23

0:13:21

0:13:21

0:09:07

0:09:07

0:10:21

0:10:21

0:06:19

0:06:19

0:05:54

0:05:54

0:09:59

0:09:59

0:11:47

0:11:47

0:11:04

0:11:04

0:11:02

0:11:02

0:15:38

0:15:38

0:04:15

0:04:15

0:03:38

0:03:38

0:07:29

0:07:29

0:06:40

0:06:40

0:13:41

0:13:41

0:00:51

0:00:51

0:08:03

0:08:03

0:14:15

0:14:15

0:08:01

0:08:01