filmov

tv

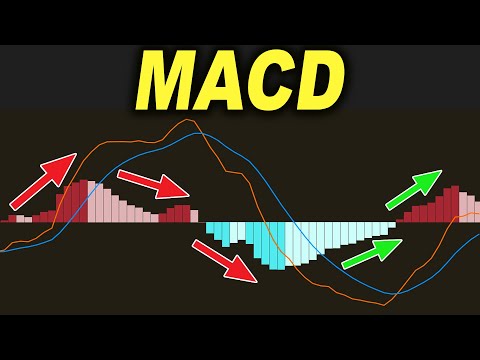

I Tested The Best MACD Trading Strategy on Youtube 100 Times ( Must Watch ! )

Показать описание

Welcome to TradeIQ! In this video I will test the best MACD trading strategy that got over 1M views on Youtube. I will backtest this strategy 100 times on Gold Spot / USD 5 min chart! Our initial account size will be $100 and we're gonna be risking 3% per trade with 1:1,5 RR. You can use this strategy when trading forex, stocks or crypto. This strategy also works on all timeframes.

Like this video if you found it helpful!

Best Crypto Exchange! Use my link to start trading on Bybit! ( Code - NR4P8R )

DISCLAIMER and RISK WARNING:

Investing and Trading have large potential rewards and also large potential risks. You must be aware of the risks and be willing to accept them. Don't trade with money you can't afford to lose. I am neither an investment advisory service nor an investment advisor. Data and information provided are solely for educational and informational purposes. Nothing in this channel and the information provided in it should be construed as a recommendation to buy or sell stocks, futures, indices, forex, cryptocurrencies or commodities.

Like this video if you found it helpful!

Best Crypto Exchange! Use my link to start trading on Bybit! ( Code - NR4P8R )

DISCLAIMER and RISK WARNING:

Investing and Trading have large potential rewards and also large potential risks. You must be aware of the risks and be willing to accept them. Don't trade with money you can't afford to lose. I am neither an investment advisory service nor an investment advisor. Data and information provided are solely for educational and informational purposes. Nothing in this channel and the information provided in it should be construed as a recommendation to buy or sell stocks, futures, indices, forex, cryptocurrencies or commodities.

Комментарии

0:08:03

0:08:03

0:07:06

0:07:06

0:16:43

0:16:43

0:12:32

0:12:32

0:01:00

0:01:00

0:10:07

0:10:07

0:20:52

0:20:52

0:01:00

0:01:00

0:04:26

0:04:26

0:11:45

0:11:45

0:11:21

0:11:21

0:05:01

0:05:01

0:00:54

0:00:54

0:09:49

0:09:49

0:01:00

0:01:00

0:10:22

0:10:22

0:10:54

0:10:54

0:05:20

0:05:20

0:00:47

0:00:47

0:00:16

0:00:16

0:00:24

0:00:24

0:00:39

0:00:39

0:10:07

0:10:07

0:06:17

0:06:17