filmov

tv

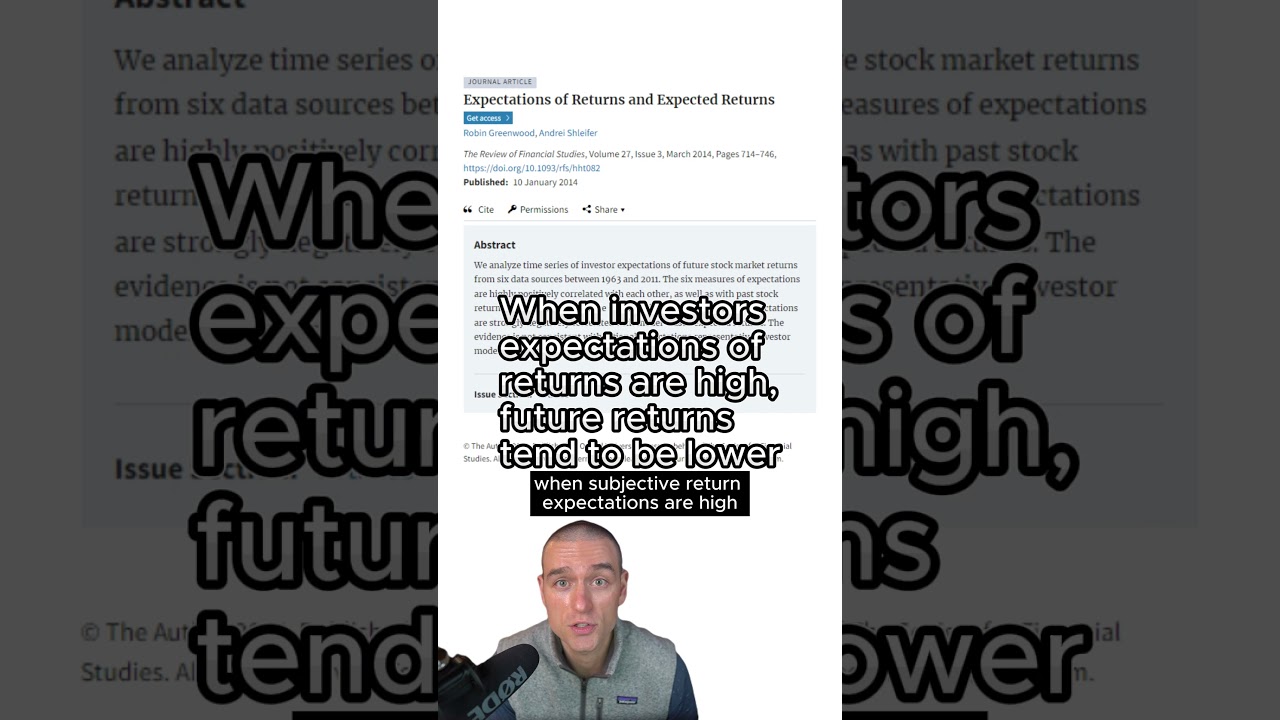

Your feelings about future returns are not expected returns!

Показать описание

Don't let your feelings guide your investment decisions.

Subjective return expectations tend to negatively correlate with model-based expected returns.

Both are predictive of realized returns, but in opposite directions.

------------------

Follow Ben Felix on

Follow the Rational Reminder on:

Follow PWL Capital on:

You can find the Rational Reminder podcast on

Google Podcasts:

Apple Podcasts:

Spotify Podcasts:

------------------

Subjective return expectations tend to negatively correlate with model-based expected returns.

Both are predictive of realized returns, but in opposite directions.

------------------

Follow Ben Felix on

Follow the Rational Reminder on:

Follow PWL Capital on:

You can find the Rational Reminder podcast on

Google Podcasts:

Apple Podcasts:

Spotify Podcasts:

------------------

Your feelings about future returns are not expected returns!

⚡️FEEL YOUR FUTURE- Joe Dispenza

Feel Your Future BEFORE It Happens | Joe Dispenza

Why You Must Feel Your Future Before It Happens...

Feel The Energy Of Your Future - YOU WILL SEE RESULTS | Mimi Bouchard

MEN ALWAYS RETURN TO YOU IF YOU ACT LIKE THIS | DENZEL WASHINGTON MOTIVATIONAL SPEECH

HOW TO CONTROL YOUR MOUTH, MIND, MOOD, AND MONEY | Audiobook

Condition your Body into the Emotions of Your Future | Dr.Joe Dispenza

Don't allow your Feelings to Forfeit your Future

🧠 How to master your EMOTIONS and FUTURE | Dr. Joe Dispenza

Feel your future. - Joe Dispenza #joedispenza #manifestation #lawofattraction #mindset #meditation

How to feel the future ✨ #joedispenza #Manifest #lawofattraction #affirmations #manifestations

Shocking Truth About Parenting: YOUR Emotions Can Shape Your Child’s Future #dealingwithfeelings

The Power of NOT Reacting - How To Control Your Emotions

Dr. Joe Dispenza: Choose Your Feelings, Create Your Future #joedispenza #neuroscience #gratitude

Future over feelings...but like also go to therapy and deal with your feelings

👉 Create a new future ! #shorts #motivation #future #emotions #past #drjoedispenza

Stay in the feeling of your future to manifest it|Dr. Joe Dispenza #drjoedispenza #joedispenza #yt

Your future doesn’t care about your feelings, it’s all about actions.

Do not let your feelings control your future! #future #success #successmindset #god #girlchat

Dr. Joe Dispenza: Use Your Emotions to Create Your Future. #joedispenza #learning #neuroscience

Your FEELINGS are CREATING your FUTURE

How to Feel Elevated Emotions | Feel the Desired Emotions of Your Future Today |

Feel Future Emotions Rewire Your Body Today 🏋️

Комментарии

0:00:59

0:00:59

0:01:00

0:01:00

0:00:56

0:00:56

0:00:40

0:00:40

0:00:48

0:00:48

0:25:17

0:25:17

3:07:13

3:07:13

0:00:59

0:00:59

0:00:46

0:00:46

0:00:51

0:00:51

0:00:54

0:00:54

0:00:28

0:00:28

0:00:32

0:00:32

0:06:37

0:06:37

0:01:00

0:01:00

0:00:09

0:00:09

0:00:13

0:00:13

0:00:58

0:00:58

0:00:25

0:00:25

0:00:44

0:00:44

0:00:29

0:00:29

0:00:40

0:00:40

0:11:38

0:11:38

0:00:50

0:00:50