filmov

tv

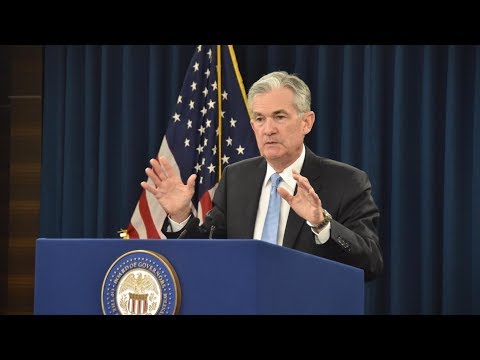

Fed Chair Powell delivers remarks at the Washington Forum on the Canadian economy — 4/16/2024

Показать описание

Federal Reserve Chairman Jerome Powell speaks at the Washington Forum on the Canadian economy in Washington, DC, in a moderated discussion with Tiff Macklem, Governor of the Bank of Canada.

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Fed Chair Powell delivers remarks at the Washington Forum on the Canadian economy — 4/16/2024

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Fed Chair Powell delivers remarks at the Washington Forum on the Canadian economy — 4/16/2024

WATCH: Federal Reserve Chair Jerome H. Powell delivers remarks on interest rates

Fed Chair Jerome Powell delivers remarks on Fed policy

Fed Chair Powell delivers remarks at the Washington Forum on the Canadian economy — 4/16/2024

Fed Chair Jerome Powell delivers remarks on rate hike

WATCH: Fed Chair Jerome Powell delivers remarks on the FOMC meeting

Fed Chair Jerome Powell delivers remarks on economic recovery from COVID-19

Fed Chair Powell delivers remarks on the economic outlook at Stanford Business School — 4/3/24

WATCH: Fed Chair Jerome Powell delivers remarks on the economy and takes questions in Zurich

VIDEO NOW: Fed Chair Jerome Powell delivers remarks on interest rates

WATCH: Fed Chair Jerome Powell delivers remarks on FOMC meeting

WATCH: Fed Chair Jerome Powell delivers remarks on FOMC meeting

WATCH: Fed Chair Jerome Powell delivers remarks at the decade's last FOMC meeting

Fed Chair Powell delivers remarks at the Federal Reserve Bank in Chicago

Fed Chair Jerome Powell delivers remarks on economic outlook

Watch Fed Chair Powell deliver remarks on the coronavirus response

WATCH: Fed Chair Jerome Powell delivers remarks following FOMC meeting

Fed Chair Jerome Powell Delivers Remarks I LIVE

Fed Chair Jerome Powell Holds News Conference — Dec. 11, 2019

WATCH: Fed Chair Jerome Powell delivers remarks on the first FOMC meeting of 2020

Fed Chair Jerome Powell delivers remarks following Fed's interest rate announcement

WATCH: Fed Chair Jerome Powell delivers remarks at the Federal Reserve Bank of Kansas City

Watch Fed Chair Jay Powell's Full Remarks From Jackson Hole

Fed Chair Jerome Powell delivers remarks following FOMC meeting

Federal Reserve Chair delivers remarks after interest rate decision

Комментарии

1:18:16

1:18:16

1:10:54

1:10:54

0:56:20

0:56:20

0:56:06

0:56:06

0:47:59

0:47:59

1:42:23

1:42:23

0:46:06

0:46:06

1:08:48

1:08:48

0:07:37

0:07:37

0:46:25

0:46:25

0:59:36

0:59:36

0:52:21

0:52:21

0:34:07

0:34:07

0:56:15

0:56:15

0:05:42

0:05:42

0:49:07

0:49:07

0:09:46

0:09:46

0:52:34

0:52:34

0:55:11

0:55:11

0:52:16

0:52:16

1:27:14

1:27:14

0:08:34

0:08:34

1:37:54

1:37:54

6:39:56

6:39:56