filmov

tv

Can we go for Strike off of Company without completing Annual Filing??????

Показать описание

To watch comedy Husband Wife Reels you may follow us on Instagram:

If you are looking for Job/ Training in CS Field join the below link group

If you have any queries, you may drop a message on WhatsApp also on 8130757966

CS Divesh Goyal

*CS - A Preferred Professional*

*Consistently working for ICSI Profession For a Decade*

#diveshgoyal #csdiveshgoyal #fcsdiveshgoyal

'Gabe, when are you going to release Counter-Strike 2?'

3 Ways To Strike More Effectively.

COPYRIGHT CLAIM vs. COPYRIGHT STRIKE (Difference)

College employees could go on strike next week

US East & Gulf Coast Port Deadline Approaches | To Strike or Not to Strike, that is the Question...

COPYRIGHT STRIKE: What It Is & How To Fix It

Counter Strike 2 is Dying BUT it's because of this...🏄 #shorts

The FASTEST way to improve in Counter Strike #shorts

Spongebob - We're going on strike

How to Survive a Lightning Strike

2 Community Guidelines Strikes In 24 HOURS (Remove Community Guidelines Strike)

Lightning Strike

Boris Johnson: Putin threatened UK with missile strike

Teacher Goes On Strike For More Pay, What Happens Next Is Shocking | Dhar Mann

Why Exactly Are We Fighting In Counter-Strike?

How to run - proper foot strike techniques

Throat Strike (Effective Self Defense Move)

SpongeBob Quits the Krusty Krab?! 🍔 'Squid on Strike' Full Scene | SpongeBob

Counter-Strike 2 HACKS IN-GAME?!

Options Trading MYSTERY: How to Choose Your Strike Price 🔍

Pupils Quiz Their Teacher About Reasons for Going on Strike 💬 | Newsround

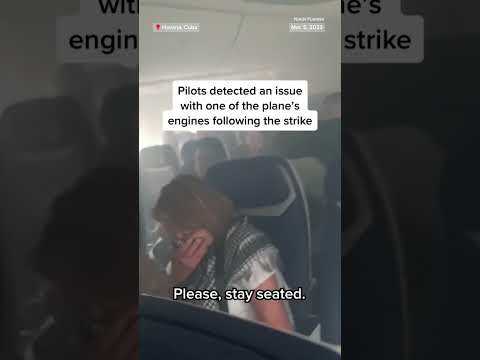

#SouthwestAirlines flight makes #emergency landing after bird strike

The Lion Guard: Return of the Roar - 'Tonight We Strike' Music Video | Official Disney Jun...

Why Railroad Workers May Go On Strike

Комментарии

0:00:29

0:00:29

0:00:22

0:00:22

0:00:44

0:00:44

0:02:18

0:02:18

0:21:47

0:21:47

0:00:48

0:00:48

0:00:35

0:00:35

0:00:28

0:00:28

0:00:33

0:00:33

0:02:27

0:02:27

0:09:12

0:09:12

0:00:16

0:00:16

0:00:50

0:00:50

0:06:52

0:06:52

0:08:13

0:08:13

0:00:14

0:00:14

0:00:54

0:00:54

0:06:21

0:06:21

0:00:47

0:00:47

0:10:55

0:10:55

0:04:36

0:04:36

0:00:21

0:00:21

0:02:15

0:02:15

0:06:05

0:06:05