filmov

tv

How to calculate a stock's expected return, variance, and standard deviation using probabilities

Показать описание

I start with a distribution of stock returns (probabilities and outcomes). I then compute the expected return, variance, and standard deviation using an Excel spreadsheet. Note these are population parameters, not estimates.

==

I'm a Finance Professor at the University of Tennessee in Knoxville. For more information about my teaching and research, please visit my website.

==

I'm a Finance Professor at the University of Tennessee in Knoxville. For more information about my teaching and research, please visit my website.

Stock Multiples: How to Tell When a Stock is Cheap/Expensive

How to Calculate the Intrinsic Value of a Stock in 2023 (Full Example)

How I Pick My Stocks: Investing For Beginners

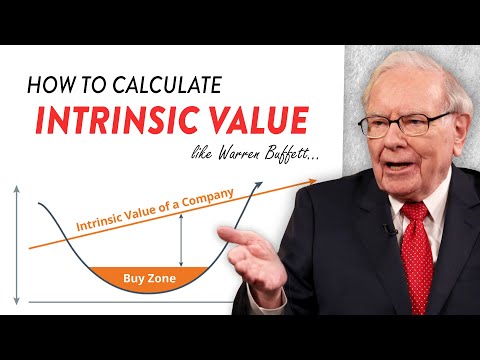

Warren Buffett Explains How To Calculate Intrinsic Value Of A Stock

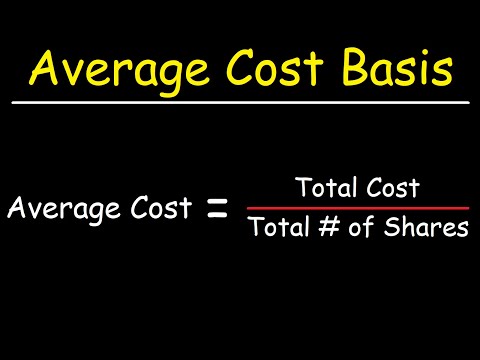

How To Calculate Your Average Cost Basis When Investing In Stocks

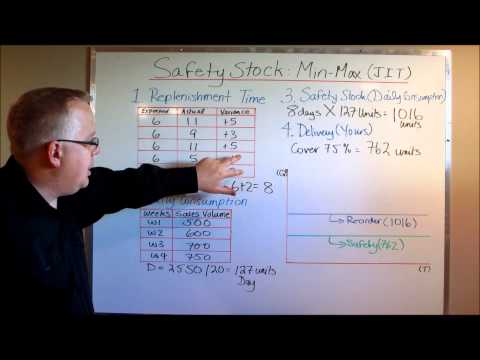

Calculating Safety Stock: Protecting Against Stock Outs

How to Calculate Stock Profit Percentage

How To Calculate the INTRINSIC VALUE of a Stock (Updated)

candlestick pattern chart | candlestick pattern hindi | stock market basics | Stocks Finance

HOW TO CALCULATE DIVIDENDS: 5 EASY STEPS

How To Calculate Lot Sizes Perfectly - Enter Forex Trades in 2 Seconds

Warren Buffett: How to Calculate the Instrinsic Value of a Stock

How To Calculate Intrinsic Value (AMZN Stock Example + Excel Template)

How to Calculate the Dow and S&P 500

How to calculate stock returns

How To Calculate Expected Move for Stocks | Trading Tutorials

How to Calculate the Intrinsic Value of a Stock like Benjamin Graham! (Step by Step)

How to Calculate the Intrinsic Value of a Stock (Full Example)

Lesson 4: How to Calculate Gain on Stock

How to Calculate Total Return on Stock

How To Calculate Intrinsic Value (Full Example)

How To Calculate Stock Returns

How to Calculate Intrinsic Value (Apple Stock Example)

Stocks for Beginners : How to Calculate Stockholder Equity

Комментарии

0:09:47

0:09:47

0:12:07

0:12:07

0:13:33

0:13:33

0:08:56

0:08:56

0:05:39

0:05:39

0:06:17

0:06:17

0:03:10

0:03:10

0:12:45

0:12:45

0:10:43

0:10:43

0:02:23

0:02:23

0:05:53

0:05:53

0:13:35

0:13:35

0:14:43

0:14:43

0:09:00

0:09:00

0:06:41

0:06:41

0:19:14

0:19:14

0:16:21

0:16:21

0:16:47

0:16:47

0:02:35

0:02:35

0:02:52

0:02:52

0:10:42

0:10:42

0:08:52

0:08:52

0:11:21

0:11:21

0:01:50

0:01:50